EP 260: The 5 Biggest Facebook Ad Mistakes + How To Get Started w/ Chad Keller – Facebook Ads Mastery Part 1

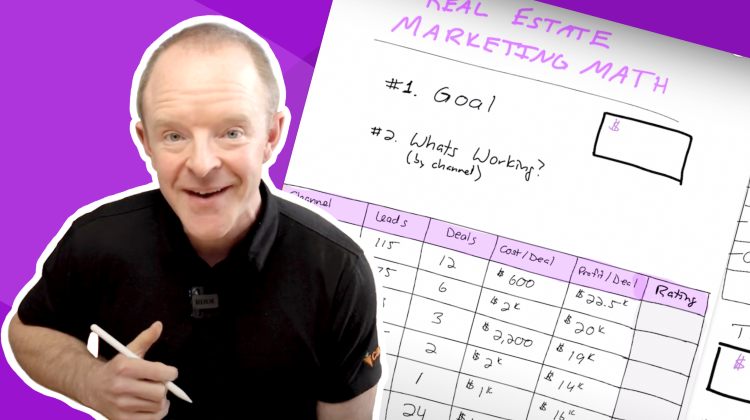

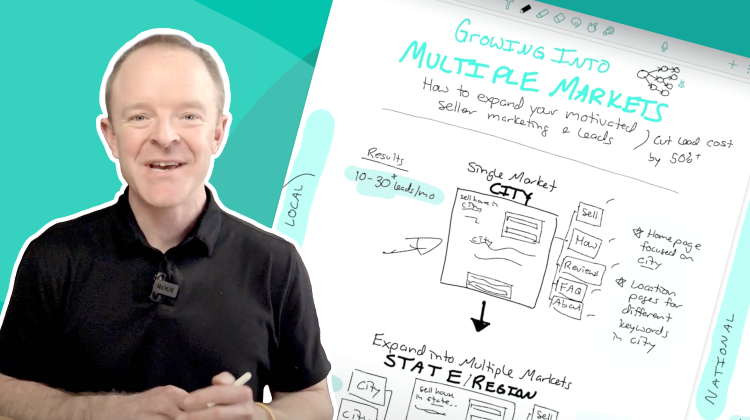

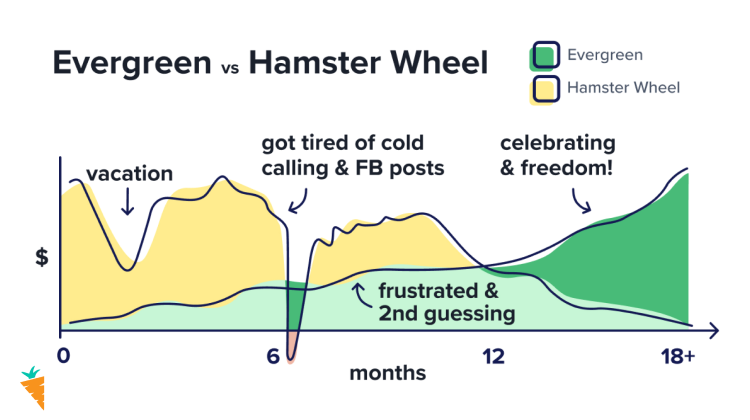

What better way to kick off a series a new series on Facebook ads than with a guy who spends MILLIONS of dollars on ads? Seriously. Through working with big companies like Dish, Macy’s, Chewy, TheChive, Sprint, and more – not to mention successfully running ads for his own investing business, Chad Keller has been testing, optimizing, and teaching others how to turn cold traffic from crappy ads into sellers that are more motivated than Tony Robbins on Red Bull. Today, we’re looking at the most costly mistakes investors & agents make. Then, in the next 3 episodes, we’ll dive into the copy, creative, budget, targeting, and how to scale campaigns. Stop blowing your marketing budget on under-performing ads & Listen to the podcast.