It’s often said that more millionaires are made through real estate than any other type of business. But what real estate business models do they use?

Ready to Hone Your Negotiation Skills & Close More Deals? Get the fool-proof strategies & step-by-step scripts used by real estate investing’s top closers

Download This Free GuideAnd while it’s difficult to measure the validity of that claim, one thing’s for sure: there’s a lot of money to be made in real estate.

Questions are often raised about whether you should become a wholesaler, a flipper, an agent or broker, or even a hybrid agent/investor.

These questions are common in market events, as we have experienced in recent years…

- Housing prices are up

- Housing sales are up

- Mortgage rates are up

- Housing inventory numbers are down

- The number of days on the market is down

- Affordability is down

Even in low inventory / high-value markets, one thing is sure: people will always buy or sell houses.

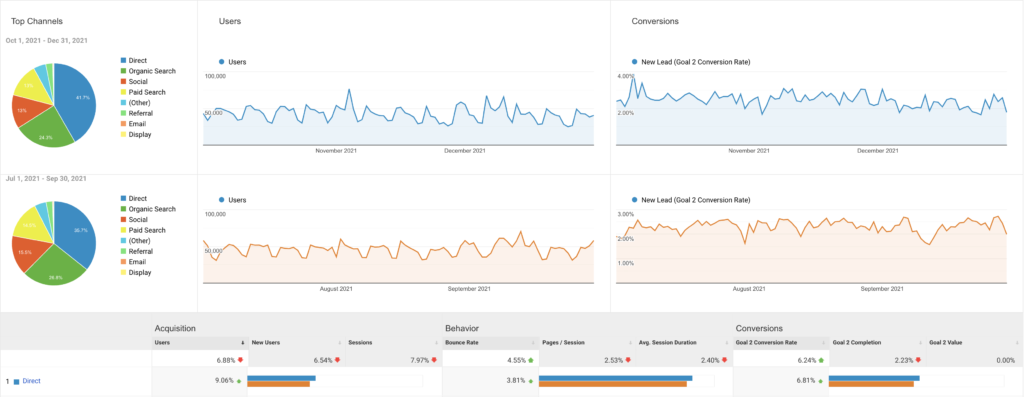

Our Carrot member data shows a Q4 quarterly increase of 6.24% in leads over Q3.

And people who put their money into real estate — buying assets rather than liabilities — ensure a lucrative future for themselves and their families.

So the question is, how should you get into real estate?

Here are nine real estate business models to consider. Prepare yourself for low inventory and changing interest rates.

The Diversity of Real Estate Business Models

There used to be just a few different real estate business models.

If you had access to a lot of capital, you could place big bets with the fix-and-flip system and hope the market didn’t dip at the wrong time. You could also buy-and-hold real estate, steadily expanding your portfolio and net worth.

You could become a real estate agent or broker without big money, netting 3% to 6% per transaction.

Those were the options.

Now things are much more diverse.

Here are the real estate business models we will cover in this article…

- Real estate agents

- Wholesaling

- Wholetailing

- Buy and hold investing

- House flipping

- Remote investing

- Listing service for FSBO

- BRRRR

- Hybrid agent/investor

The good news is… there’s a real estate business model that will work with any budget. So long as you have the discipline to get started and keep going, you can win at real estate.

The Main Challenge of These Real Estate Business Models

While the business models below present a ton of opportunity for entrepreneurs — indeed, at Carrot, we’ve seen many agents and investors build thriving businesses in just about every market — they’re not free of challenges.

These challenges include hiring the right people, being mathematical in approaching every transaction, and building trust with buyers and sellers.

But one challenge stands above all the rest: consistently generating leads.

For agents and investors, having a consistent flow of leads makes your monthly income more predictable and allows you to grow your business more quickly.

How do you do that?

At Carrot, we specialize in helping investors and agents create simple, effective websites that rank in Google (and thus drive traffic) and systematically convert visitors into leads.

We’ve generated over 2.5 million leads for thousands of investors and agents nationwide.

You can learn more about us over here.

1. Real Estate Agents

When someone thinks about getting into real estate, this is usually the first business model they consider — that of a real estate agent or broker.

Real estate agents make money by helping people buy and sell homes, usually pulling in between 3% and 6% of the sales price. A $250,000 home would net between $7,500 and $15,000.

To become a licensed realtor, you’ll need to research the requirements and processes in your local market — typically, this will include taking some courses and passing a test. You might also need to get sponsored by a real estate brokerage.

Pros

- Low barrier to entry. Anyone with enough time, determination, and sales savvy can become a real estate agent.

- Good profits on high-ticket homes.

Cons

- Requires expertise in sales.

- It takes time to build a name for yourself.

- The average transaction takes about 3 months to complete.

2. Wholesaling

Wholesaling is a real estate investing business model that’s cropped up over the last decade or so.

As a wholesaler, rather than flipping real estate or buying and holding your properties, you work as a sort of “deal finder” for other cash buyers. Your job is to find good deals (motivated sellers) and get them under contract for a price you and your cash buyer can afford. When you pass the deal onto the cash buyer, you’ll typically make a $5,000 to $20,000 assignment fee.

The most significant benefit to wholesaling real estate is that you don’t need a massive amount of money to get started — just a few thousand dollars to send out your first mailers and secure your first deal.

Pros

- No license is required (although that is steadily changing in some states)

- Requires just a few thousand dollars in startup capital.

- Tons of opportunities in most markets.

- Can make up to $20,000 or more per deal.

Cons

- Wholesaling has become highly competitive in most markets.

- New regulations are being introduced in many states to regulate wholesaling.

“6 wholesale deals this month if all goes through. $124k… 4 ppc, 1 organic, 1 Facebook retargeting. 1 have closed the other 5 are under contract with a buyer and the last one waiting on a buyer. Carrot system is still rockin”

– Brian Rockwell

3. Wholetailing

The word “wholetail” is a combination of “wholesale” and “retail”. In a wholetail deal, the investor buys a house for a low-ball price, makes just enough repairs so that it’s capable of selling on the MLS, and then sells it to a traditional buyer.

It’s not unusual to make $50,000 to $100,000 on a wholetail deal, but without nearly as much work as flipping takes.

We recommend wholetailing real estate when you’ve found a house that needs very few repairs, you can get it for a price that’s significantly under market value, and you have the cash to purchase the home (your own money or someone else’s).

Pros

- Wholetailing requires very little work but has a big payoff.

Cons

- Wholetail deals are hard to come by.

- Wholetailing works better as a supplemental investing strategy than it does a primary business model.

- Requires access to large amounts of cash.

4. Buy-And-Hold Investing

Buy-and-hold investing is probably the best business model for increasing long-term wealth and net worth. In the buy-and-hold strategy, the investor buys properties (ideally ones that are a good deal), fills them with tenants to create cash flow, and holds.

Buy-and-hold investing aims to collect as many properties as possible and build as big of a portfolio as possible.

The hardest part of this business model is securing the cash to purchase properties consistently — we recommend seeking out private money or hard money to fund your deals.

Pros

- Great way to increase net worth.

- Creates a ton of passive cash flow.

Cons

- Need to manage properties and deal with tenants.

- Need access to a lot of capital to maintain momentum.

5. House Flipping

House flipping is the HGTV method of real estate investing- perhaps the most popularized way to make it big.

What these TV shows don’t talk about, though, is how house flipping is also one of the riskier real estate business models — because during the time between when you buy a house and when you sell it (often 6 months or so), you’re just crossing your fingers that the market doesn’t take a hit.

Still, house flipping is a great real estate business model to add to your repertoire — it has higher risk but also a higher payoff, often upwards of $100,000 for a single deal.

Pros

- Bigger cash payoff than any other investing model.

Cons

- Requires a lot of fixer-upper work.

- Has a higher risk.

- Requires a lot of upfront cash.

6. Remote Investing

Remote real estate investing has only become possible for the everyday investor in the last decade.

Technology has advanced so that investors can generate leads, find deals, inspect homes, purchase properties, and more… all without even being in the same state as the property they’re purchasing.

Check out our guide here to learn more about virtual real estate investing.

This is a great option for people who don’t want their businesses tied down to a single location.

Pros

- You can operate anywhere in the U.S., accessing the most profitable markets.

- Gives you more time and freedom.

Cons

- It requires a lot of research before entering into a new market.

- Requires you to buy properties site unseen.

- You must build a business with clear-cut systems and hire trustworthy people you can depend on.

7. Listing Service For FSBO

What’s great about this business model is that once it’s set up, it can be almost entirely passive — you’ll need to hire a VA to manage some basic tasks and keep up with customer requests.

Here’s how it works: you get your real estate license, set up a website attracting FSBO sellers who want to list their house on the MLS, and offer to do it for a flat fee.

You can charge upwards of $250 per listing, for instance.

And as mentioned above, you can train a VA to do a lot of the heavy lifting. So once you’ve built the website and found ways to drive traffic (paid ads and/or SEO), this will run almost entirely on autopilot.

Pros

- Easy to set up and easy to manage.

- Decent money maker with very little work.

Cons

- Will need a real estate license.

- Will be competing with other FSBO listers.

- Will require a good chunk of upfront work to get everything set up.

- Will need to find ways to drive traffic consistently.

8. BRRRR

The BRRRR method (Buy, Rehab, Rent, Refinance, Repeat) is a modified version of the buy-and-hold business model.

BRRRR is an ongoing process by which real estate investors can purchase multiple properties with very little capital relative to the growth of their portfolios. First, the investor finds a good deal and buys the property using cash, private money, or hard money. Then they rehab the property and fill it with tenants to start the cash flow.

After a seasoning period of 12-24 months, the investor does a cash-out refinance on the home — this is where a financial institution provides a new loan on the property and returns the cash that they used to purchase the property in the first place.

Then the investor repeats that process with their original funds. If the investor plays their card right, they can purchase many properties with the same funds.

Pros

- Allows for faster portfolio growth.

Cons

- Requires the investor to secure upfront funding.

- Requires very accurate math.

9. Hybrid Real Estate Model

The hybrid real estate model is a strategy where an agent is also an investor. So, you are essentially serving sellers up with multiple different offers.

It’s a cash offer. Hey, if you’re looking for speed and convenience and are willing to take a bit of a shave in equity, here’s this.

Or, if they want top dollar, here’s what we can list for them in the market.

That’s all that it is.

Pros

- Flexibility to work with different types of sellers.

- Easier to adapt to market shifts.

Cons

- Requires agents to be open to learning more about investing.

Carrot member, Anthony Beckham, is a hybrid agent/investor. He always says his average profit per deal as an investor is around $20,000 to $30,000. His average agent commission is around the $7000 to $12,000 range.

Final Thoughts

There you have it!

Those are nine real estate business models- something for everyone.

If you don’t have much starting budget, wholesaling or becoming a real estate agent are wonderful options. If you have more capital, then you might consider flipping or BRRRR.

Whatever you decide, there’s plenty of opportunity in each business model.

Good luck!

Not a Carrot member yet? Take a free interactive tour now!