Building an investing business without a real estate investment business plan is sort of like riding a bike without handlebars.

You might be able to do it… but why would you?

It’s far easier and more practical to set out on your venture with a business plan that outlines things like your lead-flow, where you’ll find funding, and which market(s) you’ll operate.

Plus, according to Entrepreneur, having a business plan increases your chances of growth by 30%.

Download Now: Free marketing plan video and a downloadable guide

So don’t skip this critical first step.

Here’s how to do it.

Real Estate Investment Business Plan Guide

In this article we’re going to discuss:

- What is a real estate investment business plan?

- How to create your real estate investment business plan

- Conclusion

What is a Real Estate Investment Business Plan and Why Does it Matter?

A real estate investment business plan is a document that outlines your goals, your vision, and your plan for growing the business.

It should detail the real estate business model you’re going to pursue, your chosen method for lead-gen, how you’ll find funding, and how you plan to close deals.

The kit and caboodle.

BUT…

It shouldn’t be overly complicated.

Whether this real estate investment business plan is only for your personal use or to present to someone else, simplicity is best. Be thorough, be clear, but don’t over-explain what you’re going to do.

As far as why you should have a business plan, consider that it gives you a 30% better chance of growing your business.

Also, consider that setting out without a plan would be like — full of unexpected twists and turns — is that something you want to do?

Probably not.

It’s worth taking a few days or weeks to put together a business plan, even if it’s just for your own sake. By the time you’re complete, you’ll have greater confidence in the business you’re setting out to build.

And an entrepreneur’s confidence is everything.

How to Create Your Real Estate Investment Business Plan

Now we get into the nitty-gritty.

How do you create your real estate investment business plan? Here are the 10 steps!

1. Create Your Mission & Vision

This can be considered your “summary” section. You might not think that you need a mission statement or vision for your real estate business.

And you don’t.

We know a lot of real estate investors (many of our members, in fact) don’t have a clear mission or vision that they’ve outlined — and they’re successful regardless.

But if you’re just getting started…

Then we think it’s a worthwhile use of your time.

Because if you don’t know why you’re going to build your real estate investing business, if you don’t see what purpose it serves on a personal and professional level, then it’s not going to be very exciting to you.

You can either use this time to create a mission for your business… or a mission statement for you as it relates to growing your business (depending on your goals).

For instance…

- Our mission is to create affordable house opportunities in the Roseburg, Oregon community.

- Our mission is to provide homeowners with an exceptional experience when selling their properties for cash.

Or you could go a more personal route…

- My mission is to create a business that supports my family.

- My mission is to build a company that gives me more time for what matters most to me.

Or you could do both…

- My mission is to create a business that supports my family, and my business’ mission is to provide homeowners with an exceptional experience when selling their properties for cash.

Either way, it’s good to think about this before getting started.

Because if you know why you’re going to build your business — and if, ideally, that reason resonates with you — then you’ll be more excited and determined to work hard toward your goals.

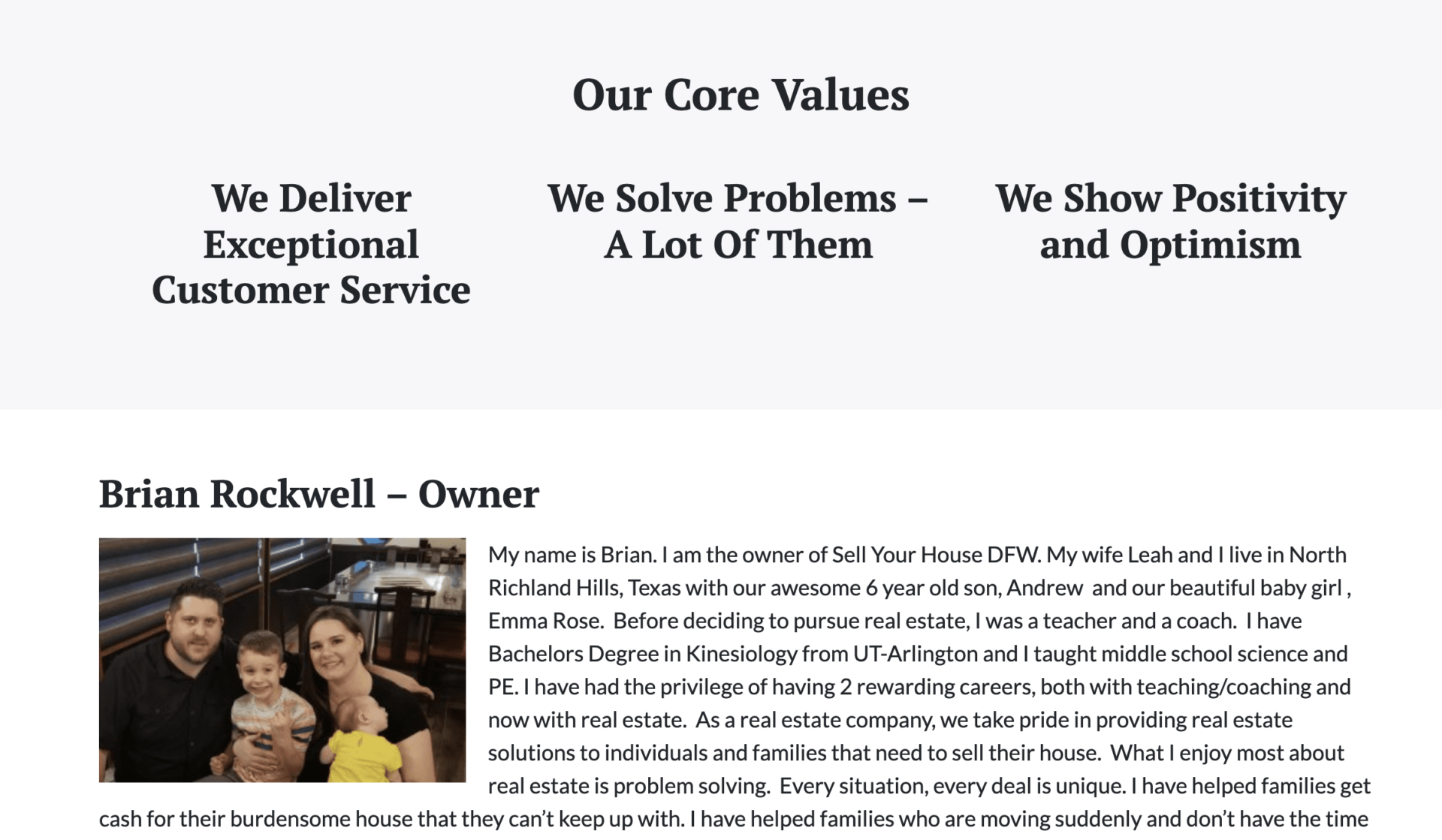

It is also an excellent opportunity to outline the core values you’ll adhere to within your business as Brian Rockwell does on his website…

With this information in hand, you’re ready to move on to the next step.

2. Run Competitive Market Analysis

Which market are you going to operate in?

That might be an easy question to answer — if you’re just going to operate in the town where you live, fair enough.

But it’s worth keeping in mind that today’s technology has made it possible to become a real estate investor in any market from pretty much any location (remotely).

So if the market you’re in is lacking in opportunity, then you might consider investing elsewhere.

How do you know which market to choose?

Here are the 10 top real estate markets for investors, according to our own Carrot member data of over 7000 accounts, based on lead volume…

- Dallas, TX

- Atlanta, GA

- Houston, TX

- Chicago, IL

- Charlotte, NC

- New York, NY

- Los Angeles, CA

- Orlando, FL

- Philadelphia, PA

- Phoenix, AZ

And here are the top 20 states…

- Texas

- California

- Florida

- Virginia

- Illinois

- Georgia

- Ohio

- New York

- North Carolina

- Pennsylvania

- New Jersey

- Oregon

- Washington

- Kansas

- Arizona

- Indiana

- Michigan

- Colorado

- Missouri

- Tennessee

That’ll give you some ideas.

But what makes a market good or bad for real estate investors? Here are some metrics to pay attention to when you’re doing your research.

- Median Home Value — This will tell you how much the average home sells for in the market, which will impact whether you’ll be willing to operate there. Because obviously, you want to play with numbers that feel reasonable to you.

- Median Home Value Increase Year Over Year — Ideally, you want to invest in a market where homes are appreciating every year. And a positive increase in this metric is a good sign that the properties you invest in will continue to increase in value.

- Occupied Housing Rate — A high housing occupancy rate means it’s easy to find tenants, and there’s a healthy demand for housing. That’s a good sign.

- Median Rent — This is the average cost of rent in the market and will give you a good idea of how much you’ll be able to charge on any rentals you own.

- Median Rent Increase Year Over Year — If you’re going to buy rentals, it’s a good sign if rental costs increase every year.

- Population Growth — When the population grows, it creates demand for housing, both rentals and on the MLS. That’s a good sign for a real estate investor.

- Job Growth — Job growth is a sign of a healthy economy and indicates that you’ll have an easier time capitalizing on your real estate investments.

Fortunately, all of this research is super easy to do on Google.

You can just type in the market and the metric in Google and you’ll get meaningful results.

Thank god for technology.

Want more freedom & impact?

From Mindset to Marketing, join our CEO as he unlocks the best stories, tactics, and strategies from America’s top investors and agents on the CarrotCast. If you want to grow your business, you need to check it out!

3. Choose Your Business Model(s)

There’s not just one real estate business model.

There are many.

And the market you’re in — as well as your business goals — will determine which business model you choose.

Here’s a brief overview of each…

- Wholesaling — Is a prevalent business model in the real estate world. Wholesalers find deals and flip them to other cash buyers for an assignment fee, typically somewhere between $5,000 to $10,000. It’s low risk and requires little capital upfront (you can get started with as little as $2,000).

- Wholetailing — Wholetailing is a mix between wholesaling and house flipping. A wholetailer will find a deal, do some very minor repairs (if any), and sell the house on the MLS themselves. It results in large profits with far less work. But wholetail deals are hard to come by.

- BRRRR — This stands for Buy, Rehab, Rent, Refinance, Repeat. It’s a long-term process for buying and holding rental properties. It’s a great way to build net worth and create generational wealth.

- Flipping — House flipping is the most popularized real estate investing method. It consists of purchasing distressed properties, fixing them up, and selling them at a good profit on the MLS, often making upwards of $100,000 per deal. However, this method involves much more risk than the other methods and each deal takes a lot longer to complete.

If you’re just getting started, then we recommend choosing just one business model and doing that until you’ve mastered it.

Down the road, you will likely want to use multiple business models.

We know the most successful real estate investors are wholesalers, wholesalers, flippers, and they own some rental properties.

That allows them to make the most of every opportunity that comes their way.

But again… to start, just choose one.

4. Determine Your Business Goals

At this point, you should have a pretty clear idea of why you’re going to build your real estate investing business.

Are you going to build it because you want to make an impact in your community? Because you want more financial freedom? Because you want more time freedom?

All of the above?

Whatever the case, now it’s time to set some goals related to your mission for the business.

Remember the SMART acronym for goal setting…

- Specific

- Measurable

- Achievable

- Relevant

- Time-Bound

Start by thinking about how much money you’d like to make per month — this should be the first income threshold that you’re excited to hit.

Let’s pretend you said $10,000 per month.

Okay, now take a look at your business model. How many properties do you need to have cash-flowing to hit that number? How many deals do you have to do per month? How many flips?

Try to be as realistic with your numbers as possible.

Here are some baselines to consider for the different business models at the $10k/month threshold…

- Wholesaling – 2-3 Deals Per Month

- Wholetailing – 2-3 Deals Per Month

- BRRRR – $1 Million in Assets

- Flipping – 1-2 Flips Per Year

Now you have a general idea of the results you’ll need to hit your first income threshold.

But we haven’t talked about overhead costs.

How much will you need to spend to get those results?

Your answer to that question will be influenced by the market analysis you already did. But it’s pretty standard for the price of finding a deal to hover around $2,000 for a real estate investor (if you’re doing your own advertising).

So now you’re spending $2,000 per deal, or whatever your specific number is. That’s going to have an impact on how much money you’re making. So now we can adjust your goals to be more realistic for hitting that $10k per month marker…

- Wholesaling – 4-5 Deals Per Month

- Wholetailing – 4-5 Deals Per Month

- BRRRR – $1.5 Million in Assets

- Flipping – 2-3 Flips Per Year

The idea here is to figure out how many deals you’ll have to do per month to hit your income goals.

Then work that back into figuring out how much you’ll need to spend every month to realistically and predictably hit your goals.

At $2k per deal and intending to hit $10k/month, here’s what your deal-finding costs might look like…

- Wholesaling – 4-5 Deals Per Month – $8k-$10k/month

- Wholetailing – 4-5 Deals Per Month – $8k-$10k/month

- BRRRR – $1.5 Million in Assets – $6k-$8k/month

- Flipping – 2-3 Flips Per Year – $4k-$6k/month

That should give you a baseline.

How do those numbers look?

If they feel too high for you right now, lower your initial goal — you want to make your first goal something that you know you can accomplish.

Then, as you gain experience, you can increase your goals and make more money down the road.

Free Real Estate Marketing Plan Template

Take our short survey to find out where you struggle most with your online marketing strategy. Generate your free marketing plan video and downloadable guide to increase lead generation and conversion, gain momentum, and stand out in your market:

Download your marketing plan template here.

5. Find Funding / Cash Buyers

Are you going to fund your own deals or find private investors? Or maybe you’re going to get a business loan from a bank?

If you’re just starting as a wholesaler or wholetailer, then it’s recommended funding your own first few deals — that should only cost $2,000 to $5,000… and why overcomplicate things in the beginning when you’re still trying to learn the ropes?

However, as a wholesaler or wholetailer, you’ll still need to find some cash buyers.

Here’s a great video that’ll teach you how to do that…

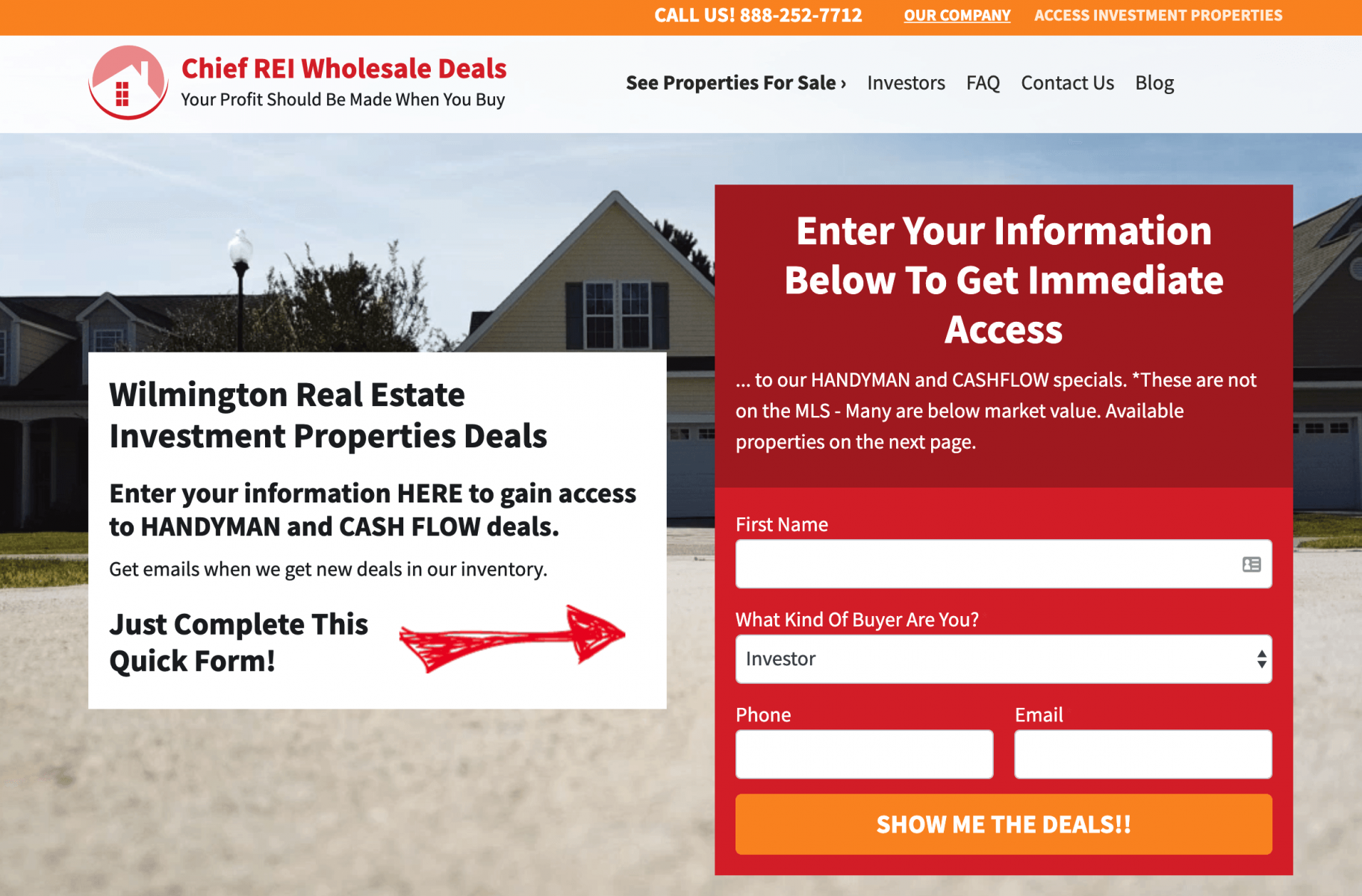

To consistently grow your cash buyer list (which is an important part of the wholesaling and wholestailing business model), we also recommend creating a buyer website like this…

Learn more about creating your cash buyer website with Carrot over here.

To scale, you might seek out other sources of funding.

Here are some options…

- Bank Loan — Getting a loan from a bank might be the most straightforward strategy if you’re just getting started. But keep in mind that the requirements for a loan on an investment property will be more stringent than the requirements were for your primary residence mortgage. And the interest rate will likely be higher as well. For that reason, you might seek out some of the other options.

- Hard Money — Hard money loans come from companies that specifically serve real estate investors. They are easier and faster to secure than a bank loan and hard money lenders typically base their approval of the loan on the quality of the investment property rather than the investor’s financial standing.

- Private Money — Whereas a hard money loan comes from a company; a private money loan comes from an individual with a good chunk of capital they’re looking to invest. That could be a friend, family member, coworker, and acquaintance. Interest rates and terms on these loans are typically very flexible and the interest rate is usually quite good. Private money is an excellent option for real estate investors looking to scale their business.

But before you seek out funding from those sources, get clear on what exactly you’re going to use those funds for.

Finding funding is even more critical. In fact — if you’re flipping properties or using the BRRRR method.

(It’s a key part of the BRRRR method)

You’ll likely want to use hard money or private money to fund your deals as you grow your business.

Okay…

But how do you find and secure those loans?

Hard money lenders are easy to find — just Google for hard money lenders in your area and call the companies that pop up to get more details.

Private money (which usually has more favorable terms than hard money) is a bit trickier to find but not at all impossible.

To find private money lenders, you can…

- Tell Friends & Family — This should be the first thing you do. Tell everyone you can about the business you’re building and the returns you can offer investors. Then ask them if they know anyone who might be interested in investing.

- Network — After you’ve exhausted all your friends and family, make a point of getting to know people everywhere you go. The easiest way to do this is to wear branded clothing so people ask about what you do. Talk to people at coffee shops, grocery stores, movie theaters, and anywhere else that you frequent. You never know who you might meet.

- Attend Foreclosure Auctions — Foreclosure auctions are jam-packed with people who have cash-on-hand to buy properties. These people might also be interested in investing in your real estate endeavors. Or they might know where to find private money. Either way, it’s in your interest to build relationships with these people. Attend foreclosure auctions and bring some business cards.

Here are some tips on finding private money lenders…

6. Identify Lead-Flow Source

Now let’s talk about how you will generate a consistent flow of motivated leads for your business.

Because no matter which of the business models you’ve chosen… you’re going to need to find motivated sellers.

And you’re going to need to find those people every single month.

There are essentially two parts to a successful lead generation strategy for real estate investing business.

Both pieces are critical…

- The Short Term — We call this “hamster-wheel marketing” because it requires you to keep working and spending money to generate leads. Examples include Facebook ads, direct mail, bandit signs, cold calling, driving for dollars, and other tit-for-tat strategies that will burn you out if you’re not careful.

- The Long Term — We call this “evergreen marketing” because it requires an upfront investment… but that investment pays off for years and years to come. Examples include increasing brand awareness for your business in your target market(s) and improving your website’s SEO, so that motivated sellers find you.

Short-term tactics are critical when you’re first starting — in fact, they are likely going to be your only source of leads for at least the first few months.

Here are some more details on the most popular and effective methods…

- Direct Mail — This should be your go-to method in the beginning. Send a few thousand direct mail pieces to the lists below and see how many calls you get in return. Expect to close about 1 in 25 calls (that’s pretty typical for this method).

- Tax default mailing lists

- Vacant house lists

- Expired listing lists

- Pre-foreclosure lists

- Out-of-state landlord lists

- Cold Calling — This might be more uncomfortable than stubbing your toe on a piece of furniture, but it can still be effective for finding motivated sellers. We have an article all about colding calling — it even has scripts for you to use.

- Facebook Ads — Facebook ads is another excellent method for generating leads so long as you have a high-converting website to send them to. If you don’t, get yourself a Carrot website. Each Carrot site is built to convert. Here are some more details about running successful ads on Facebook for your real estate investing business.

- Google Ads — Google Ads is one of the most popular platforms for real estate professionals needing to provide quick results with a minimal to high investment depending on markets.

But over time, the goal is to invest in more long-term evergreen marketing tactics so that you can get off the hamster wheel and build a more sustainable business.

Check out the video below to learn more about the critical distinction between short-term and long-term marketing.

At Carrot, we’ve created an online marketing system that makes generating leads super easy and simple for real estate investors.

And it’s 100% evergreen.

Here’s an example of one of our members’ websites that converts like crazy…

Try our free Marketing Plan Generator here.

7. Gather Property Analysis Information

We just talked about how you can generate leads.

But once someone calls you, once you’re checking out a property… How will you know if the property is a good fit for your chosen business model?

After all, not every property will be a fit.

First, ask the following questions when the seller calls…

- What is the address of the house you want to sell?

- How many bedrooms, bathrooms does it have?

- Does it have a garage, basement, or pool?

- If you were going to list it with a Realtor, what repairs and/or updating would you say would be needed?

- How much is owed on the house?

- Do you have an asking price in mind?

- Is the house behind on payments?

- If I come out and look at the property and make you a cash offer to buy it ‘As-Is’ and close as soon as you want, what would be the least you would be willing to take?

That will provide you with a lot of critical information about what you’re dealing with.

Next, once you’re off the phone, do a bit of due diligence and look at what nearby properties of similar size have sold for in the last 90 days or so — that should give you a ballpark idea for the after-repair value of the property.

If you decide that the property sounds promising, you’ll want to walk through it and take pictures of anything and everything that’ll need to be repaired.

Back at the office, estimate the cost of those repairs — here’s a great resource from REISift that’ll help you estimate rehab costs.

You’ll need to go through this entire process regardless of your business model so that you understand your max offer on the property.

So how do you calculate your max offer?

Use the 75% rule — check out this video from Ryan Dossey…

With that, you’ll know how much to pay for the property, how much to spend on repairs, and how much it’ll sell for.

The more you streamline this part of the process, the better.

8. Create Your Brand

Building a company is one thing.

Building an easily recognizable brand and known to be reputable in your marketplace is quite another.

But that’s an integral part of the process. Consider some of these statistics…

- Using a signature color can increase brand recognition by 80 percent.

- It takes about 50 milliseconds (0.05 seconds) for people to form an opinion about your website.

- Consistent presentation of a brand has seen to increase revenue by 33 percent.

- 66 percent of consumers think transparency is one of the most attractive qualities in a brand.

When it comes to building a real estate investing brand, your goals are to…

- Establish Rapport

- Create Easy Recognizability

- Dominate The Conversation

The first step in this process is building an online presence – that means creating a high-converting website (i.e., one that systematically turns visitors into leads by capturing their contact information), running advertisements, and ranking in Google for important keywords.

That’s what we can help you with at Carrot.

Out of the box, our website templates are built to convert visitors into leads – and you can customize them however you want with your branding materials…

You’ll even receive immediate text notifications when someone signs up to be a lead so that you can contact them right away (speed is the name of the game!).

Having a high-converting website is ground zero for brand-building success. If you don’t have a website that systematically converts visitors into leads, then every dollar you spend on advertising is going to be wasted.

So that’s where we start.

Once you’ve got your website up and running, then – if you’re a Carrot Member and subscribe to the Content Tools add-on – we’ll provide you with blog posts every single month that are written to rank in Google for high-value keywords relevant to your specific market…

You just upload, make some minor tweaks, and publish – and the more you publish, the more traffic you’ll drive.

To help you become a true authority in your market, we also have the following tools…

- Keyword Ranking Tracker

- SEO Tool For Optimizing All Pages

- Text Notifications For Leads

- World-Class Support

- Campaign Tracking Links

- Coaching Calls

- And More!

We want to make generating leads as easy as possible for you… so you can focus on closing deals and growing your business.

You can try us here risk-free for 30 days.

If you get yourself a Carrot website, that’ll take care of the “Dominate The Conversation” part of the branding process.

But what about these parts?

- Establish Rapport

- Create Easy Recognizability

Super easy.

Establishing rapport is simply a matter of putting testimonials and case studies on your website. The more of these you have, the more people will trust your brand when they arrive on your website for the first time.

As for creating an easily recognizable brand, create a simple branding package…

- Brand Colors

- Font

- Logo

- Brand Name

And then be consistent across all platforms. Use the same colors, font, logo, and brand name on everything – online and offline.

That’ll make it feel like you’re everywhere – which is what you want.

So there you go.

That’s how you create a brand identity as a real estate investor. You’ll know you’ve done it right if people are coming to you out of nowhere – because a friend of a friend told them about you.

And if you want a brand that dominates your market without all of the footwork, we’ve got just the thing – it’s called the Authority Leader Plan… and we’ll do everything for you.

9. Set Growth Milestones

Okay – let’s pretend that you’ve taken all of the steps above.

You’ve got yourself a functioning business and brand with funding, you’ve got consistent lead-flow, and you’re even closing some deals.

Now what?

Well… you want to grow, of course!

You don’t just want to do one deal per month… you want to do three, five, or even ten deals per month.

You want to make more money, increase your net worth, grow your business, and have a significant impact.

How do you do that?

First, you set new goals and milestones for your business’ growth – how many deals do you want to be doing per month in 6 months? In a year?

Then break those goals down by quarter – and turn them into actionable to-dos.

For example, if you’re currently doing one deal per month and you want to be doing five deals per month by the end of Q2, here’s what your goals might look like…

- Q1

- Send 10,000 Mailers Per Month

- Spend $5,000 on Facebook Ads Per Month

- Hire Salesperson To Answer Phone

- Q2

- Send 10,000 Mailers Per Month

- Spend $5,000 on Facebook Ads Per Month

- Hire Acquisition Manager

- Create Workflow Process

Or maybe it’ll look a bit different. Make your to-dos as realistic as possible so that if you do those things… you’re virtually guaranteed to hit your goals.

After all, what’s the point of having goals if you’re not going to hit them?

All in all…

Set milestone goals to grow your business, turn those into to-dos and break them down by quarter. The next and final step of your real estate investment business plan might be even more important…

10. Plan To Delegate

At some point, every real estate investor has to come to terms with a straightforward fact…

You can’t build the business of your dreams on your own. You need to delegate.

You’ve got to partner with other people, build critical relationships, hire people, manage people, create systems and processes to streamline your team’s workflow, and lots more.

One of the most important areas that deserve a highlight is your client communications and satisfaction. Consider setting up a robust cloud contact center software to manage all the communications that will lead to long-term partnerships.

Building a business isn’t so much about hustling and bustling as it is about putting the right pieces in the right place.

How do you scale your business?

The answer is quite simple: you do the same things you’re doing now… but at scale – that means hiring people, training people, and creating clean-cut systems.

That’s how you grow your business.

Automate, delegate, and step outside of your business as much as possible to build a real estate investment company that serves you rather than enslaves you.

Final Thoughts on Real Estate Investment Business Plan

Whew!

What more is there?

You know how to create a mission and vision statement, run market analysis, choose an REI business model, set goals, find funding, generate leads, analyze properties, create a brand, set long-term growth milestones, and delegate.

All that’s left is action.

And reach out anytime with questions – we’re always here to help!

Featured Resource

Free Real Estate Marketing Plan

Generate your free marketing plan video and a downloadable guide to increase lead generation and conversion, gain momentum, and stand out in your market!