So you want to quit your job?

Well, you’re not alone.

In fact, according to a worldwide Gallup study published in 2017, only 15% of people are engaged while at work. The other 85%? They’re either bored, robotic, or outright hate their job.

That’s an unfortunate truth. And it gets worse when you consider that life only lasts approximately 27,375 days and the average person will spend almost 6,000 of those days working (about 21%).

Naturally, you don’t want to spend over one fifth of your life miserable, especially when you don’t have to.

That’s right. You don’t have to.

If you’re not enjoying your work, then it’s time to find something else to do.

And real estate might just be that thing.

“Woah, woah… slow down. Should I really quit my job to become a real estate investor?”

Okay. Okay. Let’s be real for a minute.

You have a family to support and bills to pay. You can’t just up-and-quit your job.

But, you can start a real estate side-hustle and work yourself out of your current job within the next six months or year.

Let me ask you a question: If you had to work 10 to 20 extra hours a week for six months to build the life and freedom of your dreams, would you do it?

Sure, for that one year, you’d have to hustle, work on weekends, and spend the evening on phone calls. But, after six months to a year, you’d be completely free to do what you want. You could quit your day job and enjoy the financial and professional freedom you’ve always dreamed of.

Ultimately, that one year of time is a small sacrifice to make for your happiness.

Still, most people won’t do it.

They’ll make excuses, saying, “This is too hard. I’ll just stay at my current job,” or “This probably won’t work anyways.”

That, though, is where you’d be wrong.

At Carrot, we’ve helped literally thousands of people quit their day jobs, become an expert real estate investor, and build their very own real estate business.

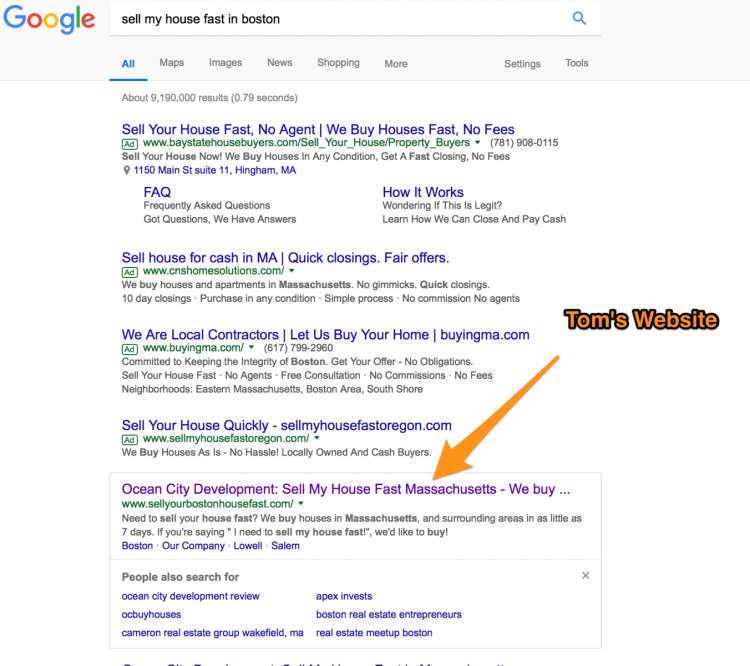

Consider Tom Cafarella who quit his job as an accountant to become a real estate investor. Now, he’s a Carrot customer and is the top wholesaler in Boston — a crazy competitive area — doing more than 100 deal every single year.

Or consider Justin Colby who went from being completely broke to closing over 100 deal ever year.

Or Brian Rockwell who was a high-school teacher and sports coach. Now, he’s making over $80,000 every month with his real estate investing business.

Want To See The Exact System Brian Followed To Make $80k/mo?

Learn how to generate 3 leads per day to run your real estate business.

Those are just a few examples.

I could go on forever with stories of Carrot customers who’ve quit their day job and achieved true financial freedom by becoming real estate investors.

If they can do it, you can do it too.

But how?

Well, there are three different types of real estate investing to consider that will help you quit your day job and move on to bigger, greater, and more satisfying things.

1. Wholesaling

For many people who want to get into the real estate investing world, wholesaling is the answer. At least at first.

Why?

Because wholesaling doesn’t really require any serious financial investment to get started. All you need is a website, valuable connections with other real estate investors, and a strategy for finding houses in distress.

Here’s how it works.

Once the wholesaler finds a house in distress, they sign a contract on the property — usually for just a week or so — which they then try to sell to one of their investor connections (a house flipper or rental owner, for instance) for slightly more than they bought it.

Let’s say you sign a contract to buy the distressed house in cash for $40,000. Now, you don’t have to actually pay the house seller that money unless you also sell the house to someone else within the contract’s timeline. In most cases, if you don’t sell the property before the contract’s expiration date, the contract is void and you’ve lost a deal, but your bank account isn’t any worse for wear.

Let’s imagine, though, that you find an investor who will purchase the property for $45,000 (because they’re planning to spend $10,000 to remodel and then sell it for $90,000). In a week, or often, days, you just made $5,000.

If you’re good at building connections with people and handling home sellers in difficult situations — divorce or death of a family member, for example — then this is the perfect job for you.

2. House Flipping

If you have some capital that you’re willing to spend — or you’re willing to get a loan — then house flipping can also be a great introduction to real estate investing.

However, you’ll need to do a bit more market research. You’ll need to understand, for instance,

- What makes a house sell for more than it’s actually worth.

- Which upgrades people prefer to see when buying a home.

- The direction of the real estate market (is the market going up or down?).

- How to design a strategy for marketing your house once it’s remodeled and for sale.

House flipping starts with buying a home that is in distress. Often times, you’ll find yourself buying from wholesalers. You buy the home for $60,000, let’s imagine. Then, you spend $10,000 to remodel the home. You upgrade the bathroom, the paint, and the lighting. You also fix any damage that’s been done to the home. Then, you hire a professional photographer for $500 to take pictures of the home that you can post on your website listing.

Eventually, you sell the home for $100,000, making a $30,000 profit.

Depending on how much time you have to commit and how much work needs to be done, the remodel phase can take anywhere from a few weeks to a few months to a few years. Generally speaking, though, the payout is much larger than wholesaling or even renting.

If you enjoy manual labor and you want to learn about what makes a house sell, then house flipping might be your real estate solution to quitting your job.

3. Rentals

The best part about rental properties (residential, corporate, storage, or otherwise) is that once you’ve built your empire, you generate loads of passive income.

However, there are two things that rentals require more than any other type of real estate investing.

- Up front investment.

- A maintenance strategy.

Rentals aren’t a one-and-done real estate money-making strategy like wholesaling or house flipping. Instead, you buy homes, storage units, or offices and rent those out to people who want to use the property. That means you get paid every month. But it also means you need money to buy those properties initially and you need a mechanism for managing wear and tears on the real estate.

Rentals can be a great way to build a consistent flow of passive income to your bank account. But it will take some time — unless you have a remarkable amount of money to invest upfront.

Still, all of that time or money will be well-worth it when you and your family are rolling in financial and professional freedom.

Conclusion

I know. Sometimes all of this stuff feels discouraging rather than uplifting. You see it, but you don’t know how to get there.

You hate your job, you believe that real estate investing holds the answer… but damn it, it just seems so risky.

Here’s what you need to keep in mind, though: your current job is also risky. In some ways, it’s riskier than starting your own real estate investing business. With your real estate investing business, you have complete control. At your current job, how much say do you have in the way things are done at a high level? Yeah. That’s what I thought.

Plus, you don’t have to quit your job right away. There’s nothing stopping you from starting a real estate investing side-hustle for the next six months to a year.

In fact, that’s exactly what I recommend. Get your business off the ground, then take the leap.

You’ll have to work a bit harder for the remainder of this year, but the rest of your life will be far more enjoyable because you did.

What do you think? Is it worth it?

Want To See The Exact System Brian Followed To Make $80k/mo?

Learn how to generate 3 leads per day to run your real estate business.