Are you ready to step into the ring and take on the world of real estate with NO money down, NO experience, and NO traditional financing?! That’s right, folks—if you’ve been sitting on the sidelines, dreaming of making it big in real estate, NOW is your moment! And I’m here to show you how to dominate the game with one of the most powerful strategies in real estate: wholesaling!

Demo Carrot: How many deals are you losing to your competitor’s website?

Take a Free DemoWholesaling is like body-slamming your way into the real estate market. You find deeply discounted properties, lock them down with a contract, and then tag in your cash buyer to close the deal—without ever owning the property yourself! You’re the ultimate middleman, connecting motivated sellers with hungry cash buyers and raking in the profits. No heavy lifting, just smart moves and fast wins.

This is the best entry point for beginners who are ready to crush it. You don’t need a mountain of cash, years of experience, or a bank begging you to borrow. What you need is hustle, heart, and a great strategy. And the best part? Wholesaling sharpens your skills in negotiating, deal analysis, marketing, and building a buyer’s list—all while keeping your risk low and your potential high.

In this step-by-step guide, I’ll break it all down for you. From finding motivated sellers to analyzing deals, securing contracts, and building a cash buyer’s list, this is your ultimate playbook to score your first wholesale deal in 2025.

Are you ready to step into the spotlight and make your real estate debut? Let’s get to work and get you on the path to your first wholesale victory! The time is now!

The key, of course, is finding a good deal.

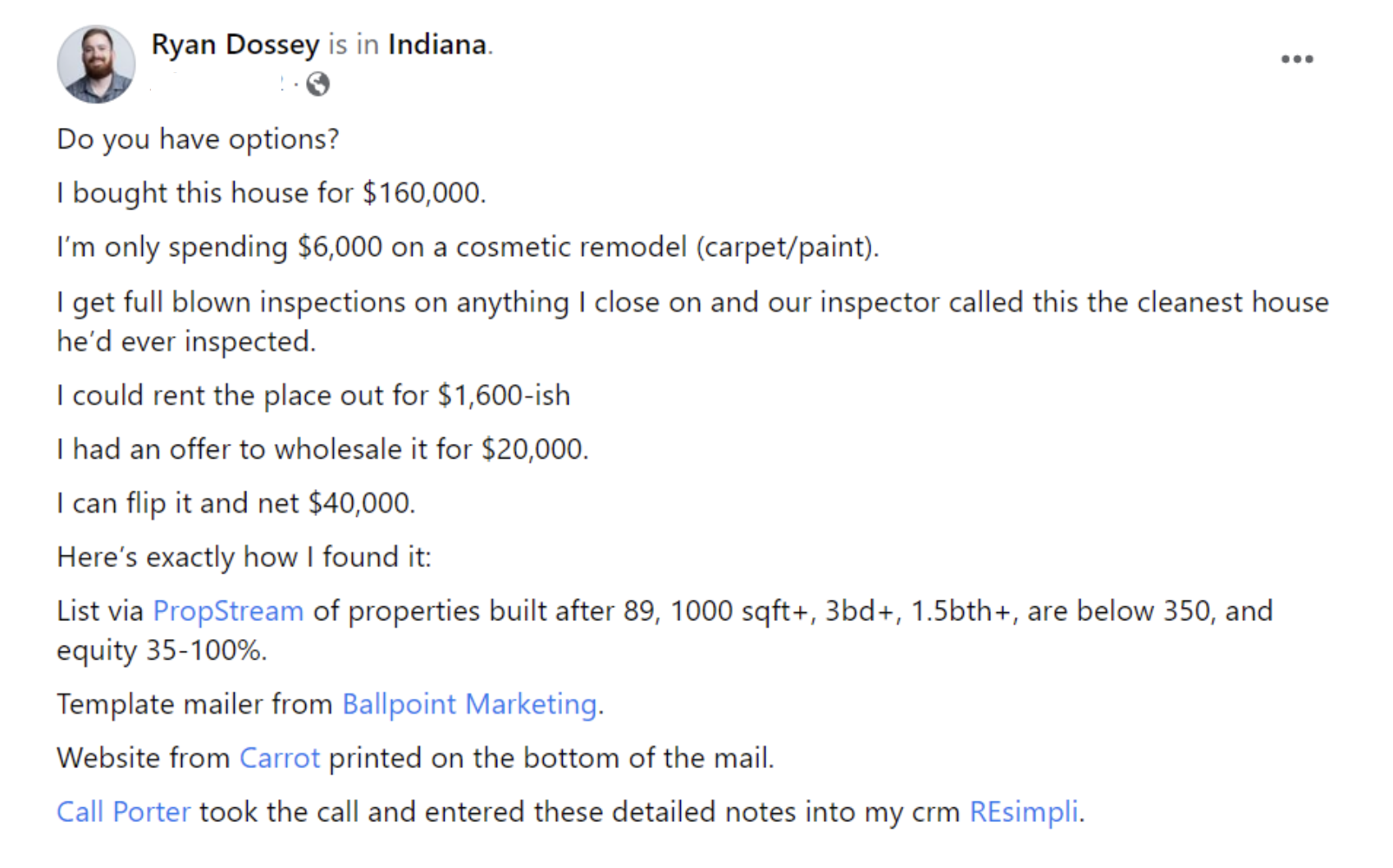

Here’s an example of how Ryan Dossey — a real estate investor in Indiana — found just one of his great deals…

List of Topics

What is Wholesaling Real Estate?

Wholesaling real estate is one of the simplest and most accessible strategies for getting started in real estate investing. At its core, wholesaling is about finding distressed or discounted properties, putting them under contract, and then assigning that contract to a buyer for a profit. Unlike traditional real estate investing, where you actually purchase and hold the property, in wholesaling, you’re simply acting as a middleman between motivated sellers and cash buyers. The goal is to profit from the spread between the price you negotiate with the seller and the price your buyer is willing to pay.

The key to wholesaling lies in assigning contracts for profit. When you find a property that’s deeply discounted, you sign a contract with the seller agreeing to purchase the property. Instead of closing on the property yourself, you assign that contract to a buyer—usually an investor—who pays you an assignment fee. This way, you can make money without ever taking ownership of the property or needing large amounts of cash to close the deal.

How Wholesaling Differs from Traditional Real Estate Investing

In traditional real estate investing, you typically buy a property, make improvements (if necessary), and either rent it out or sell it for a profit. This requires capital, the ability to get financing, and often a longer time commitment. With wholesaling, however, you’re not buying the property—you’re securing it with a contract and selling that contract to someone else. It’s a much faster process and typically requires far less money upfront.

Benefits of Wholesaling Real Estate

- Low Capital Requirements: Since you’re not buying the property outright, you don’t need large sums of money or traditional bank loans. In many cases, all you need is an earnest money deposit, which can be as little as a few hundred dollars.

- Quick Deals: Wholesale transactions typically happen in a matter of weeks, not months. Once you have the property under contract, it’s all about finding a buyer and assigning the contract, which can lead to fast payouts.

- No Need for Property Ownership: You never actually own the property in a wholesale deal, which means you avoid the headaches that can come with owning real estate—like repairs, maintenance, and tenant issues.

Wholesaling is the ultimate strategy for beginners because it offers quick, low-risk entry into real estate investing. By focusing on finding motivated sellers and building a solid buyers list, you can generate profits without the complexity and capital demands of other investment strategies. Let’s move forward and dive deeper into how to execute your first wholesale deal.

Understanding the Wholesaling Process

Wholesaling real estate is all about following a repeatable process. Once you understand the flow, you can rinse and repeat, building a profitable business from scratch. Here’s a simple breakdown of the wholesaling process:

1. Finding Motivated Sellers

The first step in wholesaling is finding motivated sellers—people who need to sell quickly and are willing to accept a discounted price in exchange for speed and convenience. These sellers are often in distress, facing situations like foreclosure, divorce, inherited properties, or simply owning a property in poor condition they don’t want to fix.

To find these sellers, you can use a variety of strategies:

- Driving for Dollars: Physically driving through neighborhoods to spot distressed properties.

- Direct Mail Campaigns: Sending postcards or letters to absentee owners or homeowners in foreclosure.

- Online Marketing: Building a Carrot website to capture inbound leads.

- Cold Calling & Texting: Reaching out to potential sellers directly with targeted lists.

Finding motivated sellers is the foundation of wholesaling success. Without motivated sellers, you won’t find deals worth wholesaling.

2. Getting the Property Under Contract

Once you’ve identified a motivated seller, the next step is to negotiate a purchase price and get the property under contract. The contract is the tool that gives you control over the property, allowing you to assign that contract to another buyer.

In this step:

- Negotiate the deal: Focus on solving the seller’s problem. Many motivated sellers are more concerned with speed and convenience than getting top dollar.

- Use a solid contract: Make sure the contract includes key terms like the purchase price, closing date, and assignment clause, which allows you to assign the contract to another buyer.

The goal is to get the property under contract at a price low enough to leave room for your end buyer (an investor) to make a profit while still allowing you to make your fee.

3. Assigning the Contract to an End Buyer

Once you have the property under contract, the next step is finding an end buyer—usually a cash investor—who’s willing to buy the contract. This is where your cash buyer list comes in. By building strong relationships with investors, you’ll have a network of buyers ready to close quickly on properties you bring them.

To assign the contract:

- Present the deal to your buyers: Share details about the property, including price, potential ARV (After Repair Value), and any necessary repairs.

- Negotiate your assignment fee: The assignment fee is the amount you’ll make from the transaction. This could range from $5,000 to $20,000 or more, depending on the deal.

The buyer steps into your place on the contract, and they’ll close on the property directly with the seller.

4. Collecting Your Assignment Fee

The final step is collecting your assignment fee. Once the end buyer closes on the property, you’ll receive your fee at closing. This fee is the difference between the price you contracted with the seller and the price your buyer is willing to pay.

For example:

- You get the property under contract for $100,000.

- You assign the contract to a cash buyer for $110,000.

- You collect a $10,000 assignment fee at closing.

That’s it—you’ve successfully wholesaled a property without needing to buy, fix, or finance anything.

Building Your Wholesaling Business Foundation

To succeed in real estate wholesaling, you need to treat it like a business from day one. Many beginners make the mistake of seeing wholesaling as a side hustle, but if you want long-term success and consistent income, you must approach it with the right mindset and structure. Let’s break down how to build a strong foundation for your wholesaling business.

Developing a Business Mindset: Treat It Like a Business from Day One

Wholesaling isn’t just a way to make quick cash—it’s a real business. From the moment you decide to wholesale, you need to think like a business owner. This means:

- Setting clear goals: How many deals do you want to close in your first year? What kind of revenue do you want to generate? Having clear goals helps you stay focused and measure your success.

- Being consistent: Consistent action is key in wholesaling. Whether it’s marketing, following up with leads, or networking with buyers, daily efforts compound over time.

- Tracking your results: Start tracking everything from day one—leads, calls, offers made, and deals closed. This data helps you see what’s working and where you need to improve.

A solid business mindset also means understanding that you’ll face challenges but being prepared to push through them and stay committed to the process.

Setting Up an LLC for Legal Protection and Credibility

One of the first steps in building your foundation is setting up a Limited Liability Company (LLC). Wholesaling is a business; just like any other business, you want to protect yourself from legal risks. An LLC separates your personal assets from your business liabilities, which is crucial if something goes wrong in a deal.

Here’s why setting up an LLC is important:

- Legal protection: If a deal goes south or you face a lawsuit, your personal assets (home, savings, etc.) are protected because the LLC is the legal entity, not you personally.

- Credibility: Operating as an LLC also makes you look more professional to motivated sellers and cash buyers. It shows that you’re serious about your business, which builds trust and increases your chances of closing deals.

- Tax benefits: An LLC can also offer tax advantages, such as write-offs for business expenses like marketing, travel, and software tools.

Setting up an LLC is easy and affordable, and it gives you the peace of mind and credibility you need to operate your wholesaling business confidently.

Tools and Software You Need (CRM, Marketing Platforms, etc.)

Running a successful wholesaling business requires more than just hustle—you need the right tools to stay organized, automate tasks, and scale your efforts. Here are the essential tools and software you should consider:

- CRM (Customer Relationship Management): A CRM helps you manage your leads, track communication, and follow up with sellers and buyers. In wholesaling, follow-up is key, and a CRM ensures that no lead falls through the cracks. Popular CRMs for wholesalers include InvestorFuse and Podio.

- Marketing Platforms: You’ll need marketing tools to generate leads and find motivated sellers. Here are a few essential platforms:

- Direct Mail Services: Use platforms like Ballpoint Marketing or Yellow Letters HQ to send direct mail to targeted sellers.

- Carrot Website: A Carrot site can be one of your most powerful tools for generating inbound leads online. By optimizing your website for SEO and running paid ads, you can attract motivated sellers who are ready to take action.

- SMS and Cold Calling Tools: Services like Batch Leads or Launch Control make it easy to reach out to potential sellers via text or phone calls.

- Deal Analysis Tools: To evaluate deals, you’ll need tools to run comps and calculate the ARV (After Repair Value). Platforms like PropStream or Batch Leads allow you to pull property data, analyze deals, and determine the right price to offer.

- Transaction Management: Once you have a property under contract, you’ll need a system to track the closing process. Platforms like Dotloop or DocuSign allow you to manage documents, contracts, and signatures online.

By investing in the right tools and setting up systems from the start, you’ll be able to operate more efficiently, scale your business, and focus on the highest-value tasks—finding deals and closing them.

In short, building your wholesaling business foundation means treating it like a real business, protecting yourself with an LLC, and using the right tools to streamline your process. This solid foundation will set you up for long-term success. Let’s move on to finding motivated sellers and getting deals under contract!

Finding Motivated Sellers

In wholesaling, finding motivated sellers is the foundation of your success. A motivated seller is someone who needs to sell quickly, usually because of financial distress, personal reasons, or because they simply don’t want to deal with the property anymore. These sellers are willing to accept a lower offer for the convenience and speed that a cash sale provides. As a wholesaler, it’s your job to find these people, offer a solution, and turn their property into a profit.

Motivated sellers are key because they create opportunity. The deeper the discount you can negotiate with a motivated seller, the larger your potential profit when you assign that contract to a buyer. Without motivated sellers, your deals won’t have enough margin for you or your investors to make money.

Here’s how you can find motivated sellers using tried-and-true strategies.

Strategies for Finding Motivated Sellers

1. Online Marketing: Using Carrot Websites to Attract Leads

Your Carrot website is a powerful tool for attracting inbound leads—people who are actively searching online to sell their homes fast. Sellers who visit your site and fill out a form are often highly motivated and ready to take action. By creating content optimized for SEO (Search Engine Optimization), you can rank your website on Google for key terms like “sell my house fast ” or “cash home buyers in .”

Here’s how to make the most of your Carrot website for lead generation:

- Create hyper-local content: Write blog posts or pages targeting specific cities and neighborhoods where you’re looking for deals.

- Run paid ads: Google Ads and Facebook Ads can drive immediate traffic to your site, generating leads even faster.

- Optimize for conversions: Make sure your website is easy to navigate, with clear calls-to-action (CTAs) that encourage visitors to contact you for an offer.

A well-optimized Carrot website can automatically produce motivated seller leads, helping you scale your business while you sleep.

2. Direct Mail Campaigns: Targeting Absentee Owners, Pre-Foreclosures, and More

Direct mail remains one of the most reliable ways to generate leads from motivated sellers, especially when you target specific groups like:

- Absentee owners: People who own properties but don’t live in them, often landlords or investors who may be tired of managing rentals.

- Pre-foreclosures: Homeowners facing foreclosure are often highly motivated to sell before they lose their home.

- Probate properties: People who inherit properties may want to sell quickly to avoid dealing with maintenance or taxes.

To run a successful direct mail campaign, you’ll need a targeted list of homeowners. You can get these lists through services like PropStream, ListSource, or Batch Leads. Craft a compelling postcard or letter offering a fast, hassle-free cash sale, and send it out consistently. Many wholesalers close their first deals through this strategy.

3. Driving for Dollars: Spotting Distressed Properties

Driving for Dollars is one of the most direct ways to find properties that may belong to motivated sellers. This involves physically driving through neighborhoods and looking for distressed properties that are showing signs of neglect, such as:

- Overgrown lawns

- Boarded-up windows

- Peeling paint or damaged roofs

- Notices on the door

Once you spot a potential distressed property, write down the address and do some research to find the owner. You can then reach out to them directly to see if they’re intereste

4. Cold Calling & SMS Marketing: Scripts and Tools for Outreach

Cold calling and SMS marketing are direct, proactive approaches to reaching potential sellers. With the right list and tools, you can contact homeowners and start the conversation about buying their property. This method can be especially effective when targeting lists like absentee owners or pre-foreclosures.

Here’s how to get started:

- Cold Calling: Use a dialer like Batch Dialer or Mojo Dialer to quickly make calls to your targeted list. When cold calling, it’s important to have a script that introduces you, explains your interest in buying their home, and offers a solution. Keep it short and to the point:

- “Hi, I’m [Your Name], a local investor, and I’m looking to buy a few more houses in your area. Would you be interested in a cash offer for your property?”

- SMS Marketing: Texting is less invasive and often gets higher response rates than cold calls. Tools like Batch Leads or Lead Sherpa allow you to send bulk messages to your target list. Keep your message short and clear, like:

- “Hi, this is [Your Name], I’m a local buyer interested in purchasing properties in . Would you consider selling your home for cash?”

These outreach methods are all about volume—the more people you reach out to, the more opportunities you’ll have to find motivated sellers.

By using these strategies—online marketing through Carrot, driving for dollars, direct mail, and cold calling/SMS marketing—you can consistently find motivated sellers and build a steady pipeline of deals. The key is staying consistent and persistent, even when you don’t get immediate results. Now, let’s talk about how to get the property under contract once you’ve found a motivated seller.

Analyzing and Making Offers

Once you’ve found a motivated seller, the next step is to analyze the deal and make an offer. Knowing how to correctly evaluate a property and make a competitive offer is essential for your success in wholesaling. Here, we’ll break down the key components of analyzing deals: running comps, estimating repair costs, and using the 70% Rule to determine your Maximum Allowable Offer (MAO).

How to Run Comps: Determining the Property’s After Repair Value (ARV)

The After Repair Value (ARV) is the estimated value of a property after all necessary repairs and updates are made. This is crucial because it helps you determine how much the property can sell for once it’s fixed up. The ARV guides your entire offer-making process, so getting it right is key.

Here’s how to run comps:

- Use MLS data or online tools: If you don’t have access to the MLS (Multiple Listing Service), you can use tools like PropStream or Zillow to pull comps—comparable sales of similar properties in the same area.

- Select recent sales: Focus on properties that have sold within the last 3-6 months to get an accurate picture of the current market.

- Look for similar properties: The best comps are properties that are similar in square footage, bedroom/bathroom count, and property type. Stay within a 1-mile radius of the property you’re evaluating.

- Adjust for condition: Compare the condition of your target property to the comps. If the comp is fully renovated and your property needs a lot of work, you’ll need to adjust the value downward.

Once you have your comps, average the sale prices to determine the ARV. For example, if similar properties in the area have sold for $250,000, then that’s likely your property’s ARV.

Estimating Repair Costs: Knowing What to Offer Based on Repairs

Understanding repair costs is another critical component of making the right offer. You don’t need to be a contractor, but having a rough idea of how much repairs will cost allows you to calculate your offer and leave enough margin for profit accurately.

Here’s how to estimate repair costs:

- Conduct a walk-through: If possible, visit the property or ask the seller for recent photos. Look for major repairs like roof issues, HVAC systems, electrical problems, plumbing, or structural damage.

- Use a repair cost guide: You can use general repair cost guidelines to estimate expenses. For example, cosmetic repairs (paint, flooring, minor kitchen updates) may cost around $10,000-$15,000, while major renovations (roof replacement, foundation repairs) could range from $20,000-$40,000 or more.

- Get contractor quotes: If you’re unsure, consider having a contractor give you a rough estimate. Over time, you’ll get better at estimating repairs yourself based on experience.

The key is to avoid underestimating repair costs—this is where many wholesalers lose deals. Once you’ve determined the repair costs, subtract this from the ARV to get a clearer picture of the property’s value in its current condition.

The 70% Rule: How to Use It to Formulate a Maximum Allowable Offer (MAO)

The 70% Rule is a simple formula that helps you determine how much you should offer on a property to ensure there’s enough profit for both you and the end buyer (typically a flipper or cash investor). It’s one of the most widely used rules in wholesaling because it balances risk with profitability.

Here’s how the 70% Rule works:

- Take the ARV of the property and multiply it by 70%. This accounts for the buyer’s profit margin (typically 30% of the ARV).

- Subtract the estimated repair costs from this number to determine your Maximum Allowable Offer (MAO).

Here’s an example:

- ARV: $250,000

- 70% of ARV: $250,000 × 0.7 = $175,000

- Estimated repair costs: $30,000

- MAO: $175,000 – $30,000 = $145,000

In this case, your MAO is $145,000. This is the maximum you should offer the seller to ensure there’s enough profit for both you and your end buyer.

Remember, your goal is to get the property under contract at a price lower than your MAO. This gives you room to assign the contract to an investor and collect an assignment fee, which is your profit.

By running comps, accurately estimating repair costs, and applying the 70% Rule, you can confidently make offers that leave enough margin for you, your buyer, and the seller to walk away happy. Let’s move on to the next step—getting that property under contract and finding a buyer!

Negotiating and Securing the Contract

Now that you’ve analyzed the deal and determined your offer, it’s time to negotiate with the seller and secure the property under contract. This is one of the most critical steps in wholesaling—if you don’t get the contract right, you risk losing the deal or even facing legal issues down the road.

Let’s walk through how to negotiate with sellers, the key clauses your contract should include, and how to explain the contract in a way that makes the seller feel confident in moving forward.

Tips for Negotiating with Sellers

Negotiation is where many new wholesalers struggle, but remember—your goal is to solve the seller’s problem, not just get the lowest price. If you approach the conversation with empathy and a solution-oriented mindset, you’re more likely to win the deal. Here are some tips to help you negotiate effectively:

- Build Rapport: Sellers need to trust you before they agree to sell their property at a discounted price. Spend time understanding their situation and genuinely listen to their needs. People are more likely to do business with someone they like and trust.

- Solve Their Problem: Focus on the seller’s pain points and offer a solution. For example, if they need to move quickly, emphasize how you can close fast with a cash offer. If they’re facing foreclosure, explain how you can help them avoid the damage to their credit.

- Be Transparent: Let the seller know that you’re an investor and that you’ll likely be working with other buyers. Be upfront about your intentions so they feel comfortable. Transparency builds trust and can prevent misunderstandings later on.

- Use the Seller’s Number First: Always ask the seller what they’re hoping to get for the property before you make an offer. This gives you a starting point and allows you to see how motivated they are. You might be surprised—they may name a price lower than you expected!

- Know Your Numbers: Confidence in negotiation comes from knowing your numbers. You’ve already run comps and estimated repair costs, so stick to your Maximum Allowable Offer (MAO). If the seller’s price is too high, politely explain why and offer them a fair price based on the property’s condition and the local market.

The Importance of a Solid Contract: Key Clauses for Wholesaling

Once the seller agrees to your offer, it’s time to lock the deal in with a purchase and sale agreement. This contract is what legally gives you the right to assign the property to an end buyer and collect your assignment fee. A solid contract is essential to protecting yourself, the seller, and the buyer throughout the transaction.

Here are some key clauses your wholesaling contract should include:

- Assignment Clause: This is the most important part of a wholesaling contract. It gives you the right to assign the contract to another buyer. Without this clause, you won’t be able to wholesale the deal. The clause should clearly state that you (the buyer) have the right to assign the contract to a third party.

- Contingency Clause: Include a contingency clause that allows you to back out of the deal if you can’t find a buyer or if unforeseen issues arise during the inspection period. Common contingencies include financing, inspection, or approval by a business partner. This protects you from losing your earnest money if the deal doesn’t go through.

- Earnest Money Deposit (EMD): The earnest money deposit shows the seller that you’re serious about buying the property. It’s typically a small percentage of the purchase price. You can often negotiate a lower EMD for wholesale deals, especially if the seller is motivated.

- Closing Date: Make sure your contract specifies a reasonable closing date. If you’re wholesaling the property, the closing date should give you enough time to find a buyer. A typical closing timeline is 30-45 days, but you can negotiate this based on the seller’s needs.

- Access to the Property: You’ll need access to the property for inspections and to show it to potential buyers. Make sure the contract gives you (or your buyers) the right to access the property during the closing period.

How to Get a Property Under Contract (Explaining the Contract to the Seller)

Getting a property under contract can be intimidating for beginners, but it’s simply a matter of walking the seller through the agreement and addressing any concerns. Here’s how to handle the conversation smoothly:

- Explain the Agreement: Go through the contract with the seller line by line, explaining each section in plain language. Let them know that this contract protects both parties and outlines the terms of the sale. Highlight key points like the purchase price, closing date, and any contingencies.

- Address Concerns: Sellers may have questions about the assignment clause or contingencies. Be ready to explain that you work with partners or investors and that the assignment clause allows you to find the right buyer quickly. Reassure them that you’re committed to closing the deal, and that contingencies are standard in real estate contracts.

- Be Patient and Professional: Some sellers may need time to think or consult with someone before signing. That’s okay. Give them the time they need, and don’t pressure them into making a decision. Maintaining professionalism and patience goes a long way in building trust.

- Sign and Seal the Deal: Once the seller is comfortable with the terms, have them sign the contract. Make sure you have all the necessary signatures, including both the seller’s and yours as the buyer. Provide a copy of the signed agreement to the seller and keep one for your records.

By following these steps and ensuring you have a solid contract in place, you can confidently move forward with the deal. With the property under contract, the next phase is finding your end buyer and getting ready to collect your assignment fee! Let’s talk about how to do that next.

Building a Cash Buyers List

One of the most critical aspects of wholesaling real estate is having a solid list of cash buyers ready to take the deals you secure under contract. Without cash buyers, even the best wholesale deals can fall apart. A strong buyer’s list ensures you have people ready to close quickly, so you can make your profit and move on to the next deal.

What is a Cash Buyer and Why They’re Crucial to Your Success?

A cash buyer is an investor or individual who can purchase a property outright, without needing traditional financing. This means no waiting around for mortgage approvals or bank inspections. Cash buyers are typically investors looking to fix and flip properties or add them to their rental portfolios.

Having a reliable list of cash buyers is crucial because:

- Fast Closings: Cash buyers can close deals quickly, sometimes within a week, which is important when working with motivated sellers who need a fast solution.

- Minimize Risk: By having buyers lined up, you reduce the risk of a deal falling through at the last minute, which can cost you both time and money.

- Repeat Business: Once you build relationships with active cash buyers, you’ll find that they often buy multiple properties from you, creating a steady income stream.

Now, let’s break down how to build and maintain a cash buyers list.

How to Build a List of Cash Buyers

A solid cash buyers list doesn’t appear overnight, but with consistent effort, you can build one that supports your wholesaling business for years to come. Here are some proven methods for finding cash buyers:

1. Networking: Attending Local REIAs and Using Social Media Groups

Networking is key in the real estate world, and one of the best places to meet cash buyers is at your local Real Estate Investor Association (REIA) meetings. These groups are full of experienced investors looking for deals, and as a wholesaler, that’s exactly what you can offer them.

Here’s how to maximize networking:

- Attend REIA meetings regularly: Get to know the local investors, share your deals, and exchange contact information. Focus on building relationships—buyers are more likely to work with wholesalers they know and trust.

- Use social media: Join real estate investment groups on platforms like Facebook and LinkedIn. Many local investor groups exist where people post deals and connect with cash buyers. When you have a property under contract, share it in these groups to gauge interest.

- Go to local meetups: Even outside of REIAs, real estate investment meetups, seminars, and conferences are great places to find buyers who are actively seeking deals.

2. Public Records: Finding Buyers from Recent Transactions

Another method for finding cash buyers is digging into public records. Whenever someone buys a property, it’s recorded in public county records, including whether it was a cash transaction.

Here’s how to find them:

- Search recent transactions: Check the local county records for recent property purchases. Look for cash transactions and record the buyer’s information. These buyers are often investors who are likely looking for more properties.

- Work with a title company: Many title companies have access to property transaction data and may be willing to share lists of cash buyers who have closed deals in your area recently.

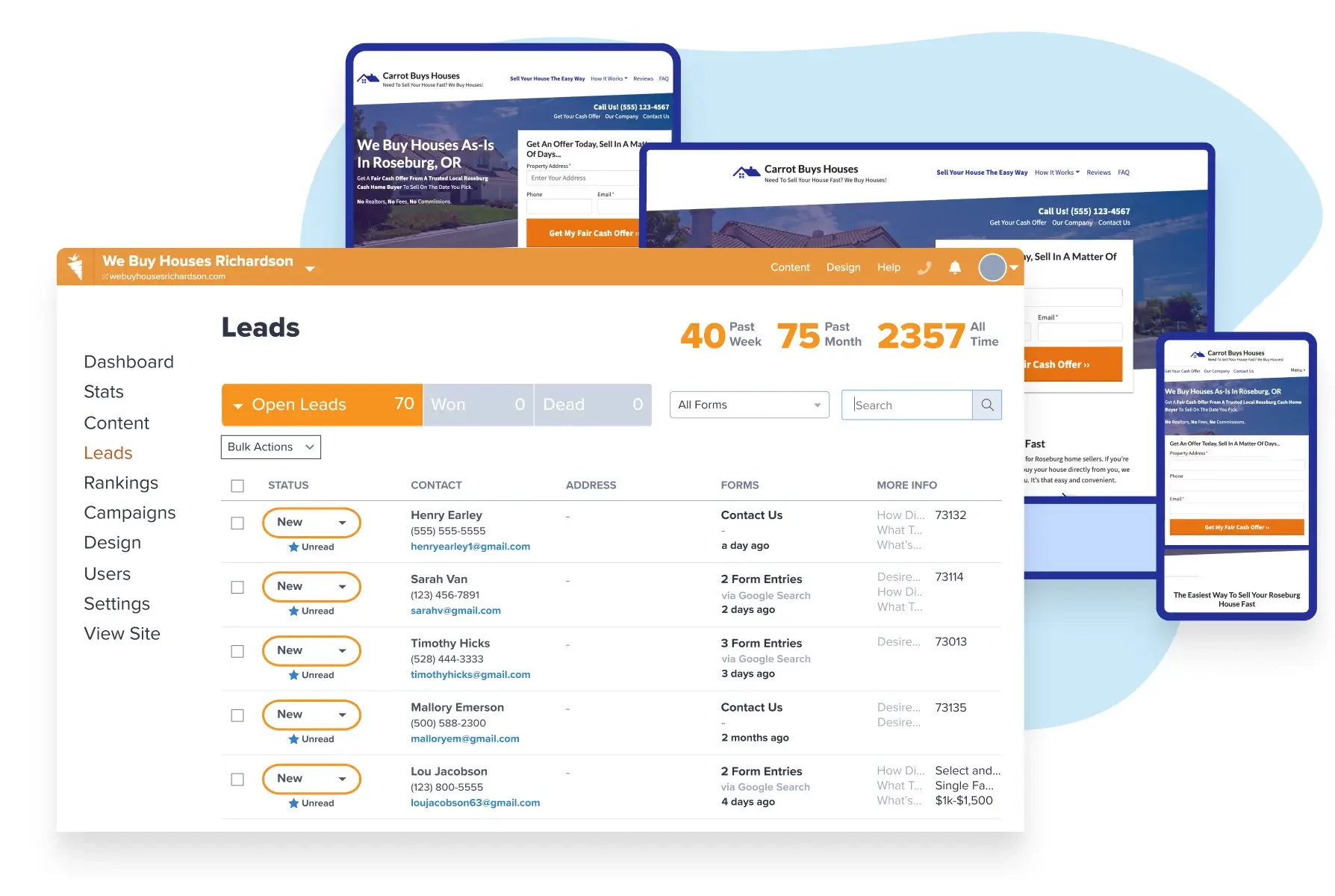

3. Online Platforms: Using Carrot’s Cash Buyer Leads Feature

If you want to streamline the process of finding cash buyers, platforms like Carrot make it easy. Carrot’s websites have a built-in Cash Buyer leads feature designed specifically for real estate investors like you.

Here’s how it works:

- Create a landing page: Set up a simple landing page using your Carrot website that offers potential cash buyers an opportunity to join your list. Make the page easy to navigate and include a form where buyers can submit their information.

- Drive traffic to the page: Share your landing page in your local REIA groups, social media, or even in your email marketing campaigns. Once buyers sign up, you’ll start collecting valuable leads you can nurture for future deals.

This automated approach can quickly grow your buyers list, allowing you to focus more on finding deals and less on manually building your list.

Communicating Effectively with Cash Buyers

Once you’ve built your buyers list, effective communication is crucial to maintain strong relationships and ensure quick closings. Cash buyers need to trust that you’ll bring them high-quality deals, and you need to ensure they can close fast.

Here’s how to communicate with your cash buyers:

- Provide detailed information: When presenting a deal to your buyers, include all relevant details—ARV, repair estimates, and your asking price. Cash buyers want to know the numbers right away so they can make an informed decision.

- Be honest and transparent: If there’s something wrong with the property (e.g., major repairs needed), let your buyers know upfront. They’ll appreciate your transparency and are more likely to work with you long term.

- Stay in touch: Even when you don’t have deals, stay in contact with your buyers. Send out periodic updates, check in on their investment goals, and ask if they’re looking for anything specific. Building a relationship keeps you top-of-mind when they’re ready for their next purchase.

By following these strategies, you’ll build a strong, reliable cash buyers list that will allow you to confidently secure contracts, knowing you have the buyers ready to close. With a solid buyers list in place, your wholesaling business will run much smoother, and you’ll be well-positioned for consistent success. Next, let’s dive into closing the deal and collecting your assignment fee!

Assigning the Contract

Once you’ve secured a property under contract and built a strong list of cash buyers, the next step in the wholesaling process is assigning the contract. This is the moment where you make your profit, so understanding how the assignment process works is crucial for a smooth deal.

How the Assignment Process Works: From Contract to Closing

The assignment process is what makes wholesaling unique. Instead of purchasing the property yourself, you’re essentially selling the rights to your contract to a cash buyer. Here’s a breakdown of how it works:

- Get the Property Under Contract: After negotiating with the seller, you’ll sign a purchase and sale agreement that gives you the right to buy the property at an agreed price. This contract is the key to wholesaling.

- Assign the Contract: Instead of closing on the property yourself, you’ll assign the contract to one of your cash buyers for a higher price. This is known as the assignment fee—your profit for finding the deal.

- Use an Assignment of Contract Form: To complete the process, you’ll need an Assignment of Contract document. This form officially transfers your rights in the original purchase agreement to the cash buyer. The buyer takes over the contract and closes on the property directly with the seller.

- Close the Deal: The cash buyer will close the deal with the seller, and you’ll collect your assignment fee at closing, typically through the title company handling the transaction.

The beauty of this process is that you never need to own the property or come up with the funds to close. Your role is simply to connect motivated sellers with eager cash buyers.

Assignment vs. Double Closing

In wholesaling, there are two primary methods for closing deals: assignment of contract and double closing. It’s important to understand the difference so you can choose the best approach for each deal.

- Assignment of Contract: This is the most common method. You assign the original contract to a buyer, and they complete the transaction. It’s fast, simple, and involves lower costs because you don’t have to purchase the property yourself.

- Double Closing: In a double closing, you actually buy the property from the seller and immediately sell it to your buyer in two back-to-back closings. This method is useful when you want to keep your assignment fee private or if the profit margin is particularly large. However, it can be more expensive since you’ll need to cover closing costs twice.

In most cases, assignment is the preferred method for beginners because it’s straightforward, and you don’t need any of your own money to complete the deal.

How to Present Deals to Buyers and Collect Your Fee

Now that you’ve secured a contract, you need to present it to your cash buyers in a way that excites them and makes them eager to close quickly. Here’s how to do it:

- Package the Deal: Present the deal in a clear, professional manner. Include all the necessary details like the property address, the purchase price, ARV (After Repair Value), estimated repair costs, and your asking price (which includes your assignment fee).

- Create Urgency: Good deals won’t last long, and you want your buyers to act fast. Let them know that you’re offering the deal to multiple buyers and it’s first-come, first-served. The more urgency you create, the faster you’ll get offers.

- Be Transparent About Your Fee: When assigning the contract, be upfront about your assignment fee. Most experienced cash buyers expect wholesalers to make a profit, so there’s no need to hide it. Transparency builds trust and long-term relationships with your buyers.

- Use a Title Company or Real Estate Attorney: A reliable title company or real estate attorney will handle the closing process and ensure everything is legal and above board. They’ll facilitate the transfer of the contract from you to your buyer, and they’ll also handle the payment of your assignment fee.

- Get Paid at Closing: Once the deal is ready to close, your assignment fee will be paid out through the title company or attorney. You’ll receive your profit without ever having to come up with the funds to purchase the property.

Mastering the assignment process is the key to consistent, profitable wholesaling. It allows you to leverage opportunities, connect buyers and sellers, and make money without taking on the financial risk of buying the property yourself. Once you’ve successfully assigned your first contract, you’ll see just how scalable and repeatable this business model can be!

Common Mistakes to Avoid

When you’re just starting out in real estate wholesaling, it’s easy to make mistakes that can cost you time, money, and even deals. However, by being aware of the common pitfalls and learning how to avoid them, you can fast-track your success. Here are three of the most frequent mistakes that new wholesalers make—and how to steer clear of them.

Overpaying for Properties: How to Avoid Paying Too Much

One of the biggest mistakes beginners make is overpaying for properties. The profitability of your wholesale deal relies heavily on securing properties at a price low enough that there’s room for both you and the end buyer to profit. Here’s how to avoid overpaying:

- Stick to the 70% Rule: This rule helps you determine your Maximum Allowable Offer (MAO) by calculating 70% of the After Repair Value (ARV) minus estimated repair costs. This ensures that you’re leaving enough margin for both your buyer and yourself.

- Run Accurate Comps: Make sure you’re using recent, comparable sales (comps) in the area to accurately estimate the ARV. Failing to run accurate comps could cause you to misprice your offer, leading to an unprofitable deal.

- Don’t Get Emotionally Attached: It’s easy to get caught up in the excitement of finding a deal, but always remember—real estate wholesaling is about the numbers. If the deal doesn’t make financial sense, walk away. It’s better to lose out on a deal than to overpay and end up stuck with a contract you can’t move.

Not Vetting Buyers: Ensuring Your Buyer Can Close

Securing a contract is only half the battle. The other half is ensuring that your buyer is actually able to close the deal. Too many new wholesalers skip the crucial step of vetting their buyers, which can result in deals falling apart at the last minute. Here’s how to ensure your buyers are solid:

- Build Relationships with Proven Buyers: Rather than scrambling to find a buyer after you have a property under contract, start building relationships with reliable cash buyers before you even begin wholesaling. Attend local real estate meetups, network through social media, and tap into online platforms to grow your list.

- Verify Proof of Funds: Always ask potential buyers for proof of funds before assigning them a contract. This ensures that they have the cash available to close the deal on time.

- Ask for References: If you’re working with a new buyer, don’t hesitate to ask for references from title companies or other wholesalers they’ve worked with. A few quick phone calls can give you peace of mind that they’re legitimate and capable of closing.

Skipping Legal Advice: Why Having a Real Estate Attorney Matters

Skipping legal advice can be a costly mistake. While wholesaling may seem straightforward, each deal involves legal contracts, and it’s critical to have someone with the right expertise on your side.

- Protect Yourself with Proper Contracts: A real estate attorney will help ensure that your contracts are legally sound and that you’re protected in case anything goes wrong. For instance, you need to ensure you have an assignability clause in your contract, which allows you to assign the contract to another buyer.

- Stay Compliant with Local Laws: Real estate laws vary by state, and wholesaling laws can be complex. Some states have specific restrictions on wholesaling, and an experienced attorney can help you navigate these regulations. Failing to comply with local laws could land you in hot water, so it’s best to have an expert in your corner.

- Avoid Legal Disputes: Having a real estate attorney involved in your deals ensures that everything is handled properly and that both parties understand their obligations. This reduces the risk of legal disputes that could arise from misunderstandings or poorly drafted contracts.

By avoiding these common mistakes—overpaying for properties, failing to vet buyers, and skipping legal advice—you’ll set a strong foundation for a successful and sustainable wholesaling business. The more cautious and prepared you are, the more smoothly your deals will run and the faster you’ll see results.Next, let’s discuss closing your first deal and scaling your business for long-term success!

Scaling Your Wholesaling Business

Once you’ve successfully closed a few deals, the next step is scaling your wholesaling business. To grow, you need to transition from hustling to setting up systems that generate leads and close deals on autopilot. Here’s how to take your business to the next level.

Systematizing Lead Generation: Automating Marketing and Follow-Up

At the heart of any successful wholesaling operation is a consistent stream of leads. However, manually handling every part of lead generation can quickly become overwhelming. To scale, you need to automate and streamline your marketing efforts:

- Leverage Online Marketing Tools: Use platforms like Carrot to build a high-converting website that attracts leads through SEO. Optimize your site for keywords like “sell my house fast” or “cash home buyers,” so motivated sellers can find you online.

- Automate Follow-Up Campaigns: Many of your leads won’t convert immediately. That’s why having a follow-up system is essential. Use CRM software to set up automated email and SMS sequences to nurture your leads. The more touchpoints you have, the better your chances of closing deals down the road.

- Use Paid Advertising: As you scale, consider using paid traffic sources like Google Ads or Facebook Ads to generate more motivated seller leads. Set a budget and let your ads run continuously to keep the pipeline full while you focus on closing deals.

By automating these processes, you can spend less time prospecting and more time negotiating and closing contracts.

Building a Team: When to Hire a Virtual Assistant or Acquisitions Manager

As you scale, you’ll reach a point where it’s impossible to handle everything on your own. This is when building a team becomes critical. Two key hires you’ll want to consider early on are:

- Virtual Assistant (VA): A VA can help with repetitive tasks like cold calling, list pulling, lead follow-up, and organizing your CRM. This frees you up to focus on high-value activities like negotiating contracts and closing deals. Virtual assistants are typically cost-effective and can be hired part-time as your business grows.

- Acquisitions Manager: An acquisitions manager can help scale your wholesaling business by handling property negotiations and contracts. They’ll focus on getting properties under contract while you focus on running the business and expanding operations. As your deal flow increases, an acquisitions manager will be essential to handling multiple deals simultaneously.

Building a team allows you to delegate tasks, maximize productivity, and scale your operations without getting bogged down in day-to-day details.

Reinvesting Profits to Scale

If you want to grow your wholesaling business, you need to reinvest your profits strategically. Here are three key areas where reinvesting can have the biggest impact:

- Marketing: Scale up your lead generation efforts by reinvesting in marketing channels that are already working. Whether it’s paid ads, direct mail campaigns, or online marketing, doubling down on what works will ensure you keep the deal flow consistent.

- Technology & Tools: Invest in tools that streamline your processes, such as CRM systems, marketing automation platforms, and real estate software for finding comps and running analyses. The right tech can save you time and make your business more efficient.

- Hiring & Training: Use your profits to bring on new team members and train them to run different aspects of your business. This includes virtual assistants, acquisitions managers, and even dispositions managers to help sell the deals. The more you reinvest in your team, the more your business will be able to handle a higher volume of deals.

Scaling your business takes time, but by investing your profits wisely, automating lead generation, and building a strong team, you’ll be well on your way to growing a successful and sustainable wholesaling operation.

By systematizing your lead generation, building a reliable team, and reinvesting your profits, you’ll set the foundation to scale your wholesaling business and take it to new heights. With consistent effort and smart decision-making, you can turn your initial deals into a thriving business that operates efficiently at scale! Ready to scale? Let’s talk about closing more deals consistently and making 2025 your most successful year yet!

Conclusion

Wholesaling real estate may seem overwhelming at first, but by following these key steps, you’ll be on the path to success:

- Understand the process: From finding motivated sellers to securing contracts and building a cash buyer list, knowing the steps is critical.

- Treat it like a business: Set up a strong foundation, use the right tools, and build a reliable team as you grow.

- Stay disciplined with your numbers: Analyze deals carefully, stick to the 70% rule, and avoid overpaying for properties.

- Be persistent: Wholesaling isn’t a “get rich quick” scheme—it’s a business that requires patience, persistence, and a willingness to learn from mistakes.

For beginners, remember that every successful wholesaler started right where you are now. The key is to stay persistent, keep learning, and continue taking action. Even when deals fall through or things don’t go as planned, each challenge is an opportunity to grow and get better.

To help you stay organized, streamline your lead generation, and automate your follow-up, I highly recommend using Carrot’s platform. With the right tools, you can focus on scaling your wholesaling business and closing more deals.

Ready to take your first step? Use Carrot to help you automate, attract motivated sellers, and build your buyer list. Get started today and make this the year you break into wholesaling!