Considering diving into real estate investing? You might have encountered the term real estate ARV (after-repair value). ARV, a significant measure in the real estate realm, is employed by both real estate investors and house flippers to gauge the potential future value of a property post-renovations.

For seasoned investors, calculating ARV is pivotal for predicting a home’s future value, aiding in securing financing for necessary repairs. However, this method isn’t exclusive to experts—it holds tremendous value for regular homeowners seeking to enhance their property’s worth through strategic changes.

Now, let’s delve into the intricacies of ARV and explore how you can leverage this valuable metric.

What is ARV in Real Estate?

Real Estate ARV, which stands for After Repair Value, refers to the estimated value of a property after all necessary repairs and enhancements have been carried out.

This metric holds significant importance for real estate investors, particularly those engaged in property flipping. It quantifies the difference between an investment property’s current “as-is” value and the projected value it will attain once the renovation is complete.

Are you curious about how fellow real estate investors determine this crucial value? Here’s a step-by-step guide on how to calculate Real Estate ARV.

How to Calculate Real Estate ARV

Imagine stumbling upon a distressed piece of real estate that piques your interest for a potential flip, whether you’re a wholesaler or a seasoned house flipper. Assuming the seller is sufficiently motivated and willing to part with their property, the next crucial step is to assess whether the deal holds the promise of profitability.

The first order of business is to calculate the ARV of the property.

It’s crucial to note, especially if you intend to fix and flip, that understanding market conditions and the expected quality of homes is paramount. This insight prevents over-repairing, ensuring that potential profits aren’t diminished.

For those in the house-flipping business, ARV is indispensable. It serves as the compass guiding your investment decisions, revealing the expected selling price post-renovation. This, in turn, informs your purchase price and dictates your budget for repairs.

If you’re a wholesaler, ARV carries even more weight. It is essential for the same reasons mentioned earlier and becomes an integral factor when dealing with potential investors. Most investors you aim to flip the property to will inquire about the ARV, wanting to review the comparable properties you’ve assessed for the investment.

So, how do you calculate ARV?

It’s simply:

ARV = (Property’s Purchase Price) + (Value of Renovations)

How to Find Your Max Bidding Price

Now you have the ARV of the home you’re considering buying.

For the sake of simplicity, let’s assume that you set the ARV of the home at $200,000 after running comps. The first thing to consider is what real estate investors call the “70% rule.”

It means that house fix-and-flippers try to pay about 70% of the ARV of a home minus the repairs needed. This gives them a healthy 30% profit and ensures they can afford any unexpected repairs and still make a profit.

What Investor Will Pay for Home = (ARV x .7) – Cost of Repairs

Assuming that the cost of repairs for the home is $20,000, here’s what that formula looks like using our $200,000 ARV example.

$120,000 = ($200,000 x .7) – $20,000

In this case, the 70% rule says the investor should pay about $120,000 for the home to make a 30% profit (about $60,000).

Not every fix-and-flipper follows this guideline, but it’s a good rule of thumb to pay attention to. If you’re fixing and flipping homes, you’ll want to consider the 70% rule when purchasing a distressed property.

You must take the math one step further if you’re wholesaling homes.

Since you’re getting cut out of the middle for finding the deal in the first place and the investor you’re flipping the home to will likely follow something similar to the 70% rule, you need to factor in a cash cut for yourself.

The formula will look more like this.

What Investor Will Pay for Home = ((ARV x .7) – Cost of Repairs) – Wholesaler’s Fee

If you wanted to make $10,000 in the middle, here is how the math works, for instance.

$110,000 = (($200,000 x .7) – $20,000) – $10,000

This means that the house fixer and flipper should expect to pay about $110,000 for our example home after you (the wholesaler) pay your fee.

Generally speaking, these numbers will be important to share with your buyer (if you’re a wholesaler) so that everyone is on the same page and understands where money is going and why you’re pricing the house at what it’s at.

You don’t always have to share these numbers (your buyer will probably run their comps anyway and apply this rule). But it’s important to have it on hand to

- Justify what you’re trying to sell the house for, and

- Ensure everyone makes a healthy profit.

Options to Help You Find Real Estate ARV

Option 1: Ask a Real Estate Agent to Run Comps

The easiest way to determine the ARV of a property is to ask a real estate agent friend of yours to run comps for you. Work to build a healthy relationship with the agent and many will do it for free. Some will require a small fee.

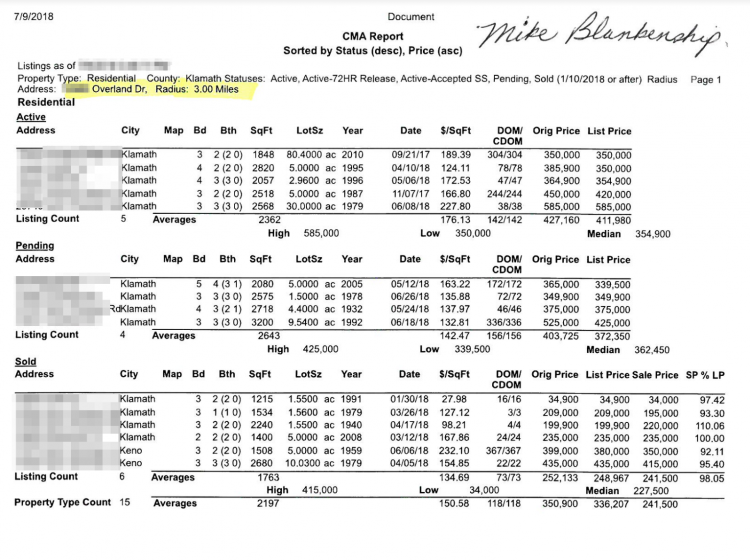

Whatever the case, when an agent runs comps, they’ll send you a report showing homes similar to the one that you’re considering buying (similar in size, location, lot size, and the number of beds/baths) that have sold recently, are trying to be sold, or are pending sale.

The report will have the details of the home (bed, bath, square footage, year built) and the price per square foot that the home is being sold for or did sell for (see “Orig Price” vs. “List Price” vs. “Sale Price”).

Here are the comps I received recently from my real estate agent buddy.

Once you have this report in hand, you need to find the most similar homes to the one you’re considering buying, average their price per square foot, apply that number to the home you’re considering buying and make slight adjustments for discrepancies. Here are a few things to keep in mind.

- If a home sold for very high or very low relative to the other similar homes you’ve compiled, don’t consider it in your calculations. Outliers like that will only throw off your ARV.

- Try to find homes that have the same number of bedrooms and bathrooms.

- Try to find homes within the same neighborhood with the same type of positioning (not next to a busy street, downslope, no neighboring houses are in distress, etc.)

- If you have to increase the radius on the comps for lack of nearby similar properties, do so sparingly and seek expert help from an agent or appraiser if needed.

Ultimately, you should have a healthy idea of what the house can be sold for once it’s repaired to market expectations.

Option 2: How to Do It Yourself

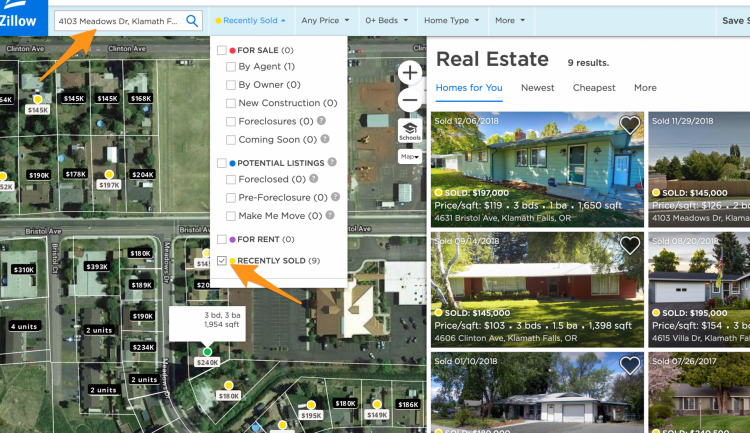

If you’d rather run comps yourself than ask a real estate agent to help you, Zillow is the most user-friendly place to do that. Not for their Zestimates, though. If I were you, I’d pay little attention to their Zestimates – many experts question their accuracy.

The best way to use Zillow to run comps is by typing in the address you’re considering buying into the search bar and changing the filter to “Recently Sold.”

Click the search icon. All the yellow dots on the screen indicate recently sold homes. Click on one or all of them, and Zillow will tell you exactly what they sold for, their square footage, how many beds and baths they have, and many other details.

Now all you have to do is find the homes that are most similar to the one you’re considering buying, put them onto a spreadsheet with the price they sold for, their price per square foot (Price Sold/square footage = Price Per Square Foot), their number of bedrooms and bathrooms, and any other pertinent details you’d like to include.

Average out the most similar home selling price tags with the bulleted list from the “Ask a Real Estate Agent to Run Comps” section of this article in mind, and you’ll have your ARV.

Are there Risks of Real Estate ARV?

Investing in real estate, particularly when considering the After Repair Value (ARV), comes with risks. Let’s explore some potential challenges:

- Market Fluctuations:

- Risk: Real estate markets can be unpredictable, and property values may fluctuate based on economic conditions, local demand, and other external factors.

- Mitigation: To make more informed predictions stay informed about market trends, economic indicators, and local developments.

- Overestimating Renovation Costs:

- Risk: There’s a risk of underestimating the actual cost of repairs and renovations, leading to financial strain and potentially reducing the project’s overall profitability.

- Mitigation: Conduct thorough inspections and consult with experienced contractors to obtain accurate estimates for repair costs.

- Extended Renovation Timelines:

- Risk: Delays in the renovation process can increase holding costs, impacting overall profitability.

- Mitigation: Create a realistic timeline, account for potential delays, and have contingency plans.

- Financing Challenges:

- Risk: Securing financing for a property based on its ARV may be challenging, especially if market conditions or the property’s condition pose risks to lenders.

- Mitigation: Develop strong relationships with lenders, maintain a good credit history, and be prepared with a solid business plan.

- Market Saturation:

- Risk: In competitive markets, oversaturation is risky, making it challenging to sell the property quickly or at the desired price.

- Mitigation: Conduct thorough market research to identify potential saturation issues and differentiate your property through unique features or strategic marketing.

- Regulatory Changes:

- Risk: Changes in zoning regulations, building codes, or other local ordinances can affect renovation plans and the property’s ARV.

- Mitigation: Stay informed about local regulations and consult with professionals to ensure compliance.

- Unforeseen Issues:

- Risk: Unexpected problems during the renovation process, such as structural issues or permitting challenges, can arise, affecting both timelines and budgets.

- Mitigation: Conduct comprehensive property inspections before purchasing and prepare for unforeseen challenges.

Real estate investors must approach ARV calculations with a clear understanding of these risks and implement mitigation strategies. Thorough due diligence, careful planning, and adaptability are key factors in navigating the potential challenges associated with ARV investments.

Conclusion

You now know how to determine the real estate ARV of a home. This is arguably the most vital skill you need as a real estate investor. The more you practice, the better you’ll get at it. And if you have any further questions, throw them in the comments, and we’ll help you however we can!