You don’t have to be lucky to get off-market properties as a real estate investor. You just need to know how to find them and how to get them to you before they go on auction sites, Zillow, or to a competitor.

These five proven methods show you exactly how to build that pipeline ethically, legally, and in a way that’s scalable.

KEY TAKEAWAYS

- There are a variety of ways to attract off-market properties, and strategies that will fit any real estate investor’s budget. Some are more manual, some produce quick results, and some set you up for long-term success.

- Real estate investors benefit from using multiple methods of attracting off-market properties to balance quick lead generation with long-term lead flow.

- You can attract off-market properties with both online and offline methods.

Attracting off-market investment properties is a good option for both new and seasoned real estate investors as there are multiple strategies and some budget-friendly options. Keep reading to see the top five ways to attract off-market properties, the pros and cons, and how to set up each one.

Table of Contents

- SEO (The Best Way to Find Motivated Sellers)

- Driving for Dollars (Most Budget-Friendly)

- Pros of Driving for Dollars for real estate investors

- Cons of Driving for Dollars for real estate investors

- PPC Ads (Fastest)

- Networking

- Radio Ads

- What’s next?

1. SEO (The Best Way to Find Motivated Sellers)

When someone types “sell my house fast” into Google, you know they aren’t casual sellers — they need to sell now and are willing to accept a lower price for speed and convenience. That’s exactly who you want to attract.

How do you make sure they come to your website?

It happens through SEO (Search Engine Optimization) — the process of getting your website to show up in top search results when sellers type phrases like “sell my house fast” or “cash offer for home” into Google.

To tell Google what phrase you want a specific page to rank for, put the phrase or some variation of it in:

- Your page title (what shows in the browser tab)

- Your website address (the page URL)

- The page’s meta description (the short description that appears under your link in search results)

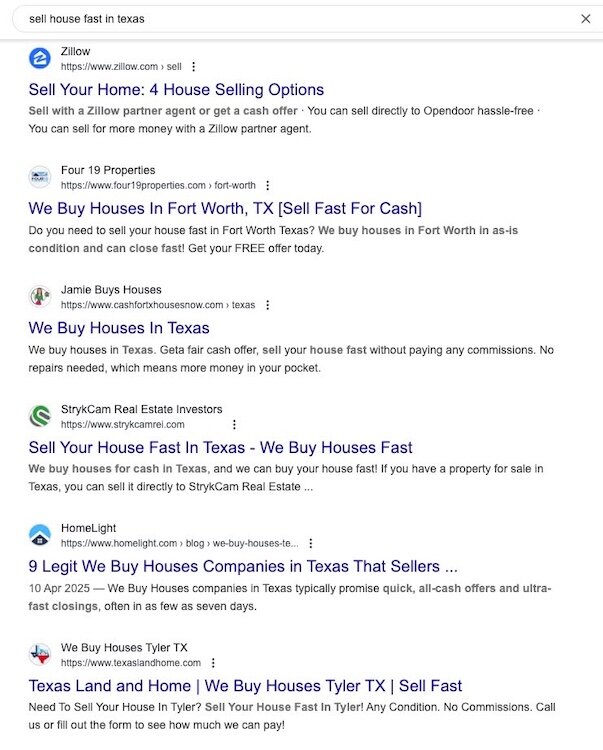

For example, if you search for ‘sell my house for cash in Texas,’ the top-ranking websites have exactly what I described:

If you look at “Jamie Buys Houses” in the screenshot above, it includes “We Buy Houses In Texas” in their title, “Texas” in their URL, and “sell your house fast without paying commissions” in their description.

It’s also good to include the phrase you’re targeting at least a couple of times in the content of your page as well.

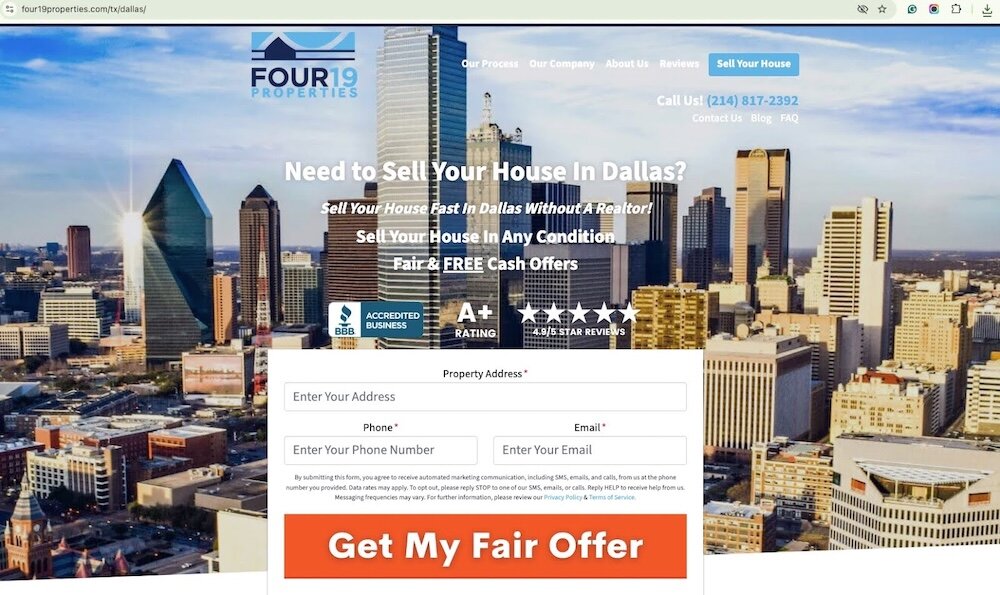

Look at Four19 Properties’ page for the keyword “sell my house for cash in Dallas.” They’ve included phrases like “sell house fast in Dallas” and “cash offer” on their page.

To find the right phrases to include on your page, you need to do keyword research. It is simply figuring out what words people actually type into Google when they’re looking to sell their house fast.

Instead of guessing which search terms to target, keyword research shows you exactly what motivated sellers are searching for (the keyword) and how many people search for those terms each month (search volume).

For example, you might discover that 720 people search for “sell my house fast Dallas” every month, but only 50 search for “Dallas home buyers.”

This tells you which phrase to focus on for better results.

You can do basic keyword research using free tools like Google’s Keyword Planner or Ubersuggest. Just type in phrases you think sellers might use, and these tools will show you search volume data and suggest related terms you might not have considered. If you’re a Carrot member, Carrot also has a built in Keyword Explorer tool so you can easily find and implement the best keywords for your site.

For a deep dive into real estate SEO best practices, check out the free guide Real Estate SEO: Top Strategies, Tips & Examples. It covers everything from keyword research to website optimization.

Pros of SEO for real estate investors:

- SEO leads convert at much higher rates because they found you, not the other way around. According to Carrot’s data, SEO leads generate approximately 2.5 times higher profit compared to leads from other sources.

- Unlike paid ads that stop working the moment you stop paying, SEO continues working for you 24/7 once you’re ranking well. You won’t have to spend time chasing leads.

Cons of SEO for real estate investors:

- SEO typically takes 3-6 months before you start seeing motivated sellers coming in. You need patience and can’t rely on it for quick deals when you’re just starting out.

- Because it’s so effective, SEO is competitive. So it can be hard to rank for the high-intent keywords like ‘sell house in {city}, ‘sell fast for cash,’ etc. (To see how competitive top keywords are in your market, search your city with Market Scout.)

- Getting your website to rank isn’t rocket science, but you’ll need to spend time learning the basics of keyword research, backlinks, etc.

If you don’t want to learn SEO yourself, there are real estate SEO experts you can work with.

2. Driving for Dollars (Most Budget-Friendly)

Driving for dollars is when you actively search neighborhoods for distressed properties that aren’t listed for sale. Though the name suggests driving, you can also walk, bike, or jog through neighborhoods — driving just covers more ground faster.

Let’s look at five steps to make driving for dollars a success.

Step 1: Pick your target neighborhoods

Start with areas you already know or where you’ve done deals before. Check your county records for zip codes with higher foreclosure rates or tax delinquencies — these often have more motivated sellers.

It helps to schedule regular 30-minute driving sessions each week rather than trying to do it randomly.

Step 2: Look for signs of distress

Look for homes with:

- Overgrown yards

- Peeling paint

- Broken windows

- Piled-up mail

- Or posted notices

Record the address and move on. Being too obvious — like taking photos or lingering — can make neighbors uncomfortable. You can do more research later on.

Step 3: Leave a note (Optional)

Leave a simple handwritten style note on the door letting the owner know you’re interested in buying.

You can write — “I noticed your house while driving by and wondered if you’d consider selling? Call me at [number].”

Or you can use pre-printed door hangers that look like they’re handwritten, like these from Ballpoint Marketing.

Just respect “No Soliciting” signs and be considerate.

Step 4: Research the property

Before adding to your marketing list, quickly check if the property is already listed for sale (check Zillow or the MLS if you have access) to avoid wasting time on properties already on the market.

Then, look up the property on your county assessor’s website (just google “[your county] property records” or “[your county] assessor”). This gives you the legal owner and usually their mailing address, which often isn’t the property address itself.

If you can’t find the owner’s current contact information, use a skip tracing service like TLO, Batch Skip Tracing, or PropStream (costs typically range from $0.25-$1 per lookup). This will get you phone numbers or the email address of the owner.

Step 5: Reach out to owners

Add these properties to your regular follow-up system.

For the highest response rates, use multiple contact methods — send a yellow letter or postcard first, then follow up with a phone call 3-5 days later.

Tracking which properties respond helps refine your targeting for future driving sessions.

Pros of Driving for Dollars for real estate investors:

- Extremely low startup cost (just gas money to get started)

- Lets you personally evaluate neighborhoods and property conditions

- Can be done part-time during evenings or weekends

Cons of Driving for Dollars for real estate investors:

- Time-intensive process requiring personal effort

- Limited by how much ground you can physically cover

- Not scalable without additional help or technology

Can you do this virtually?

DealMachine is an app that lets you browse neighborhoods through Google Street View, without actually driving there. You can identify potentially distressed properties and mark them just like you would if you were driving. It’s great if you’re short on time or want to scout neighborhoods that are far from where you live.

To improve response rates, add a QR code pointing to your website to your postcards. When sellers scan the QR code, they’ll land directly on your site, where they can learn more about your services and see that you’re a legitamate business.

3. PPC Ads (Fastest)

If you have some marketing budget, PPC (Pay-Per-Click) ads and pay-per-lead services are the fastest way to generate deals.

You set up your Google Ads account, create campaigns targeting keywords like “sell my house fast [your city],” and within hours people will be clicking and filling out forms.

But competition is fierce, and hence expensive.

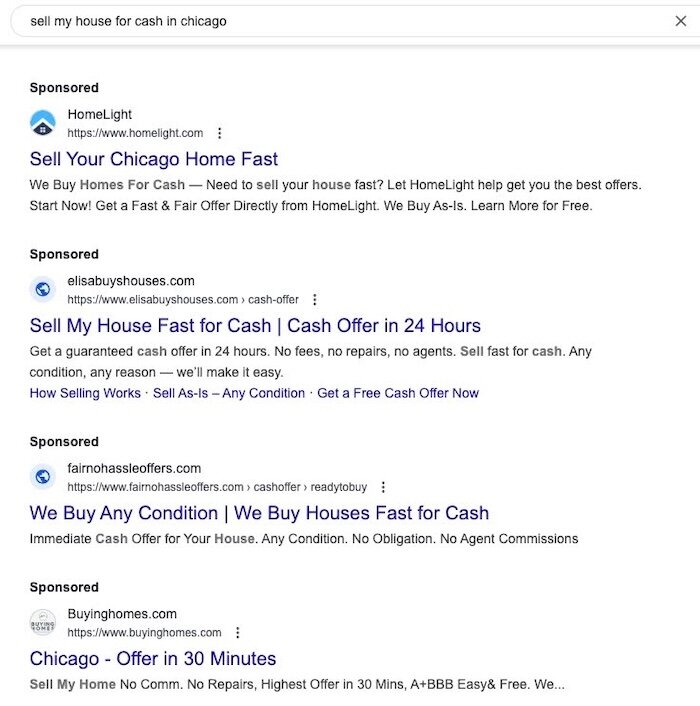

For example, when I searched for “sell my house for cash in Chicago” I saw 4-5 different ads. Meaning everyone is bidding on the same keyword.

When you have this many competitors, the cost per click skyrockets.

You might pay $15 – $50 just for someone to click your ad. If only one out of 20 people who click actually fill out your form, you’re looking at $300 – $1,000 per lead before you even talk to them.

Here are three tips to make sure you’re not burning money on ads:

1. Track every single keyword and ad.

Set up conversion tracking to see which exact keywords brought you actual seller calls. If you’re spending $500 on the keyword “sell house fast” but getting zero calls, turn that keyword off.

If “we buy ugly houses” is bringing quality leads for $50 per lead, increase the budget for that keyword. The goal is to not spend on keywords that won’t bring you quality leads.

2. Set up instant callback systems.

When someone submits your form, the system should immediately call both you and the seller, then connect you both on the same call within 30 seconds.

Most investors wait 10-20 minutes to call leads back. By then, the seller has moved on or filled out three other investor forms.

3. Your ad better stand out.

In the example above, notice how each competitor tries to differentiate themselves:

- “Cash Offer in 24 Hours”

- “We Buy Any Condition”

- “No Agent Commissions”

- “Offer in 30 Minutes”

You can’t just say “we buy houses.” You need a specific hook that makes people choose your ad over the others.

Facebook ads work completely differently than Google ads.

With Google, people are actively searching for you. With Facebook, you’re interrupting their scroll through family photos and memes.

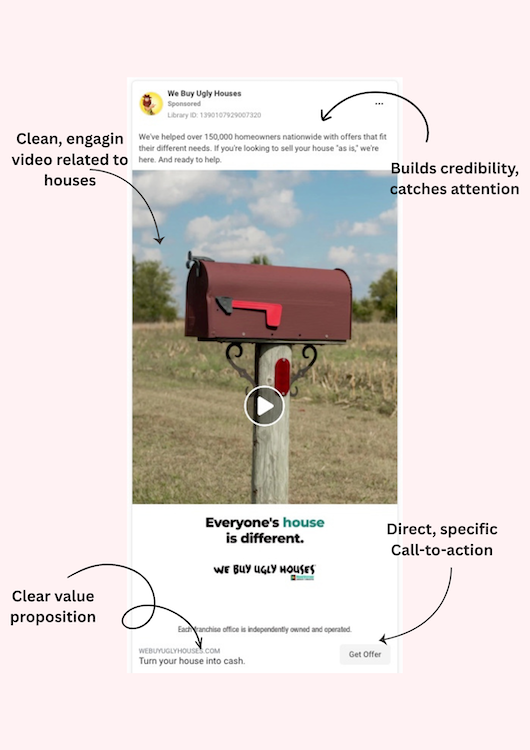

This means your creative needs to grab attention in under two seconds, and every single element of your ad needs to work together perfectly.

Here’s how to structure a Facebook ad that actually converts:

- A compelling description that builds credibility and captures attention

- A clean, engaging video (or image) related to houses

- A clear value proposition

- A direct, specific call-to-action button

Pros of PPC for real estate investors:

- Generates leads immediately after campaign launch

- Highly targeted based on specific keywords and search intent

- Scalable by increasing budget as needed

- Provides measurable ROI and performance data

Cons of PPC for real estate investors:

- Requires upfront budget

- Google Ads has a learning curve

- Lead costs vary widely depending on market competition (see the average cost-per-click for popular keywords with Market Scout)

- Success depends on quick follow-up and conversion systems

4. Networking

You can’t buy houses from people who don’t know you buy houses. So you need to get the word out about what you do.

But that doesn’t mean you waste time at generic business events making small talk. You need to connect with people who either have deals or know people with deals.

Here are some ideas:

Build professional networks.

Connect with estate sale companies, bankruptcy attorneys, and eviction lawyers. These people deal with motivated sellers every day.

Insurance adjusters deal with the “3 Ds” — Death, Divorce, and Disaster. These are exactly the situations that create motivated sellers. Make connections with them.

Go to garage sales.

What do people do before they sell their house? They get rid of junk first. Walk up to someone running a garage sale and say “Hey, I’m not here to buy anything, but are you open to selling the house too?”

Talk to everyone.

Tell every single person you meet that you buy houses. Your barber, server, Uber driver. Everyone either has a property problem or knows someone who does.

Here’s proof this works:

Post on Facebook: “I need to buy a house this month. If you bring me a deal that closes, I’ll pay you $500-$1000.” Your network might connect you with someone.

Get to know a few real estate agents.

Most agents can’t handle problem properties. Tell them: “If you get a hoarder house, something boarded up, or a place needing serious repairs, send it my way. You still get your commission.”

Now when that agent gets a problem property listing, instead of dreading it, they immediately think of you. You become their go-to solution for deals that don’t work in the regular market.

Pros of networking for real estate investors:

- Gives you access to deals that never hit the market or listing sites

- Professionals like agents and attorneys can pre-screen deals based on your criteria

- Relationships tend to strengthen and improve over time

Cons of networking for real estate investors:

- Requires consistent follow-up to stay top-of-mind

- Results often come in unpredictable waves rather than a steady flow

- Hard to scale beyond your personal capacity to maintain relationships

5. Radio Ads

Radio can be an underrated way to generate motivated leads. There’s a misconception that they don’t work. But that’s because most investors pay way too much.

Check out this interview with Chris Arnold to learn more about how he relied on radio advertising to build and grow multiple companies.

Here are the steps you can follow to get started with radio advertising:

Step 1: Choose the right stations

There are three main radio genres to target:

- Urban stations – for deals in cities with younger demographics

- Rural stations – for small town and countryside properties

- Over 50 stations – for older homeowners who are more likely to sell

Ask stations for their demographic breakdowns — listener data showing age, income, and location of their audience — and advertise on stations that match your seller persona.

Step 2: Negotiate pricing and secure good time slots

Start with relationship building: Find a media buyer who already has relationships with radio stations. Solo investors rarely get the pricing they need to make radio profitable.

Negotiate hard: Posted rates are just starting points. Most stations have flexible pricing, especially for longer-term commitments.

Target prime listening times: Book morning and evening rush hours when people are actually in their cars listening.

Write your own ads (avoid the station’s help)

Radio stations will offer to help write your ad. Avoid them completely. They don’t understand how to position you to motivated sellers.

This framework works great:

- Call out the problem your listener has

- Present your solution

- State who you are clearly

- Give a clear call to action

Keep it empathetic, not aggressive.

People are nervous and possibly heartbroken during the selling process. Don’t use harsh language like “We’ll stop your foreclosure now!” or “Get quick cash and leave your home!”

Step 3: Set up your phone system before you launch

Use easily memorable phone numbers for radio. Something with repeating numbers or similar sounds works best. People hear your ad while driving and need to remember your number instantly.

You can also set up unique phone numbers for each station so you can track which ones generate the most calls.

Pros of radio ads for real estate investors:

- Radio makes you sound like the established expert in your market compared to other investors

- Most investors don’t use radio, so you’re not fighting five other “we buy houses” ads

Cons of radio ads for real estate investors:

- Without good negotiation skills or connections, you might pay $280 for what others get for $20

- You need to answer live calls throughout the day, not just when your ad plays

What’s next?

Most investors spend all their time and money trying to get leads. They send out mailers, put up bandit signs, and make cold calls. But then what happens when someone actually calls?

They write the person’s info on a sticky note, and forget to call them back for three days.

Getting leads is only half the battle. The real money comes from actually turning those leads into closed deals.

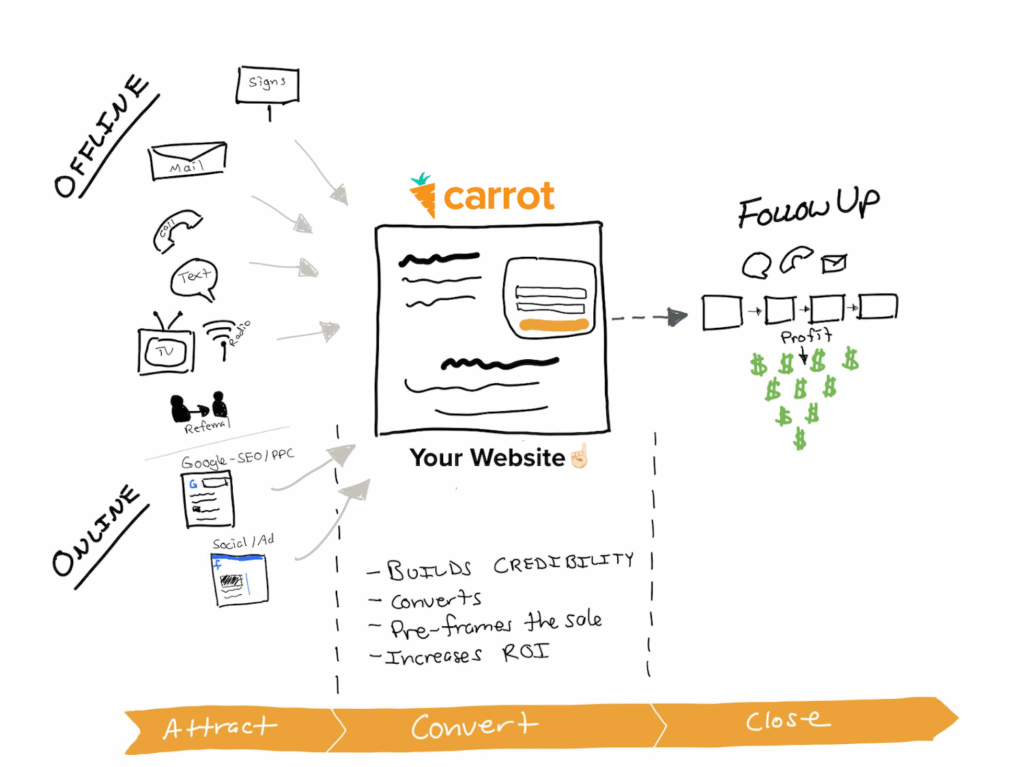

That’s where Carrot comes in.

It’s not just a website builder. It’s a complete system with CRM and digital marketing tools designed specifically for real estate investors to capture leads and turn them into deals.

The data proves it works: Carrot leads convert 7 times better and are 2.5 times more profitable than non-Carrot leads. The average Carrot lead is worth nearly $1,900 compared to just $102 for non-Carrot leads.

Even in competitive markets, investors with a Carrot website hold 45% of top search positions in most U.S. metros. With over 1 million motivated seller leads generated, the platform works whether you’re tech-savvy or not.

Check out Carrot today and see why thousands of investors trust their websites, lead capture, and follow-up systems to this powerful platform.