We surveyed over 7,000 of our members to pinpoint the primary real estate investor websites and services that investors depend on in their day-to-day operations.

Demo Carrot: How many deals are you losing to your competitor’s website?

Take a Free DemoKey Takeaways

Investors use a variety of websites, tools, and services to gather information and generate leads.

In this article, we will analyze the top 10 real estate investor service websites in-depth. We show why these real estate investor websites are indispensable resources for individuals currently engaged in real estate investing and those contemplating entering this field.

Table of Contents

- Carrot – Real estate websites, online marketing tools & CRM

- Roofstock – Single family rental investments

- Mashvisor – Short-term rentals data & listings

- Stessa – Property managemental software

- BatchLeads – AI-powered property seach

- DealMachine – News, Community & Networking

- BiggerPockets – Real estate investor news, community & networking

- SparkRental – Fractional real estate investing

- PropStream – Real estate information provider

- RealtyMogul – Real estate crowdfunding & investing

Top 10 Real Estate Investor Websites

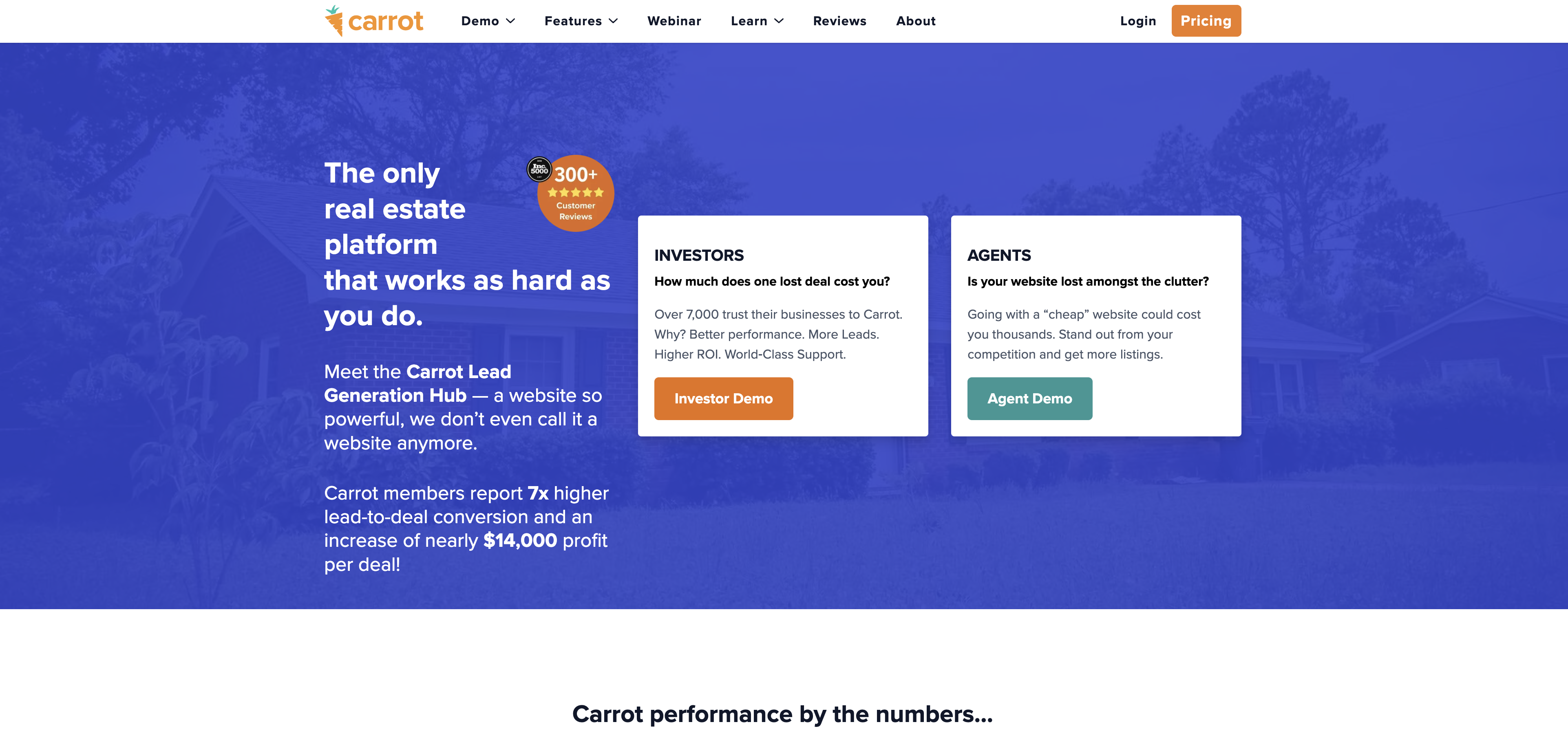

1. Carrot

At Carrot, we aim to enable real estate professionals with a high-performing website that acts as a Lead Generation Hub.

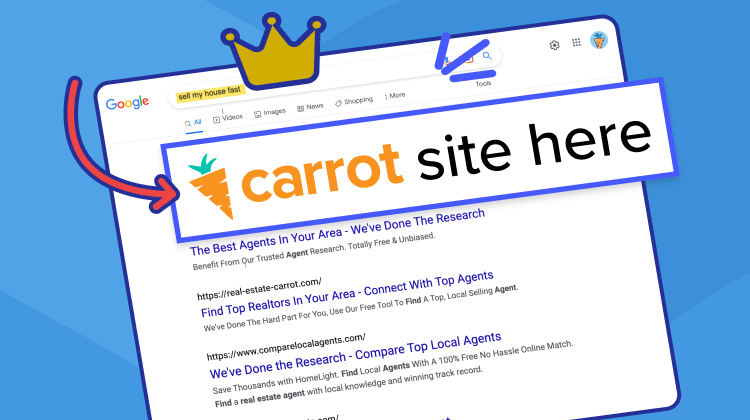

Carrot websites are optimized for Google Core Web Vitals, page speed, and SEO best practices.

But you don’t have to take our word for it.

Check out these Carrot reviews…

We also have data to back it up.

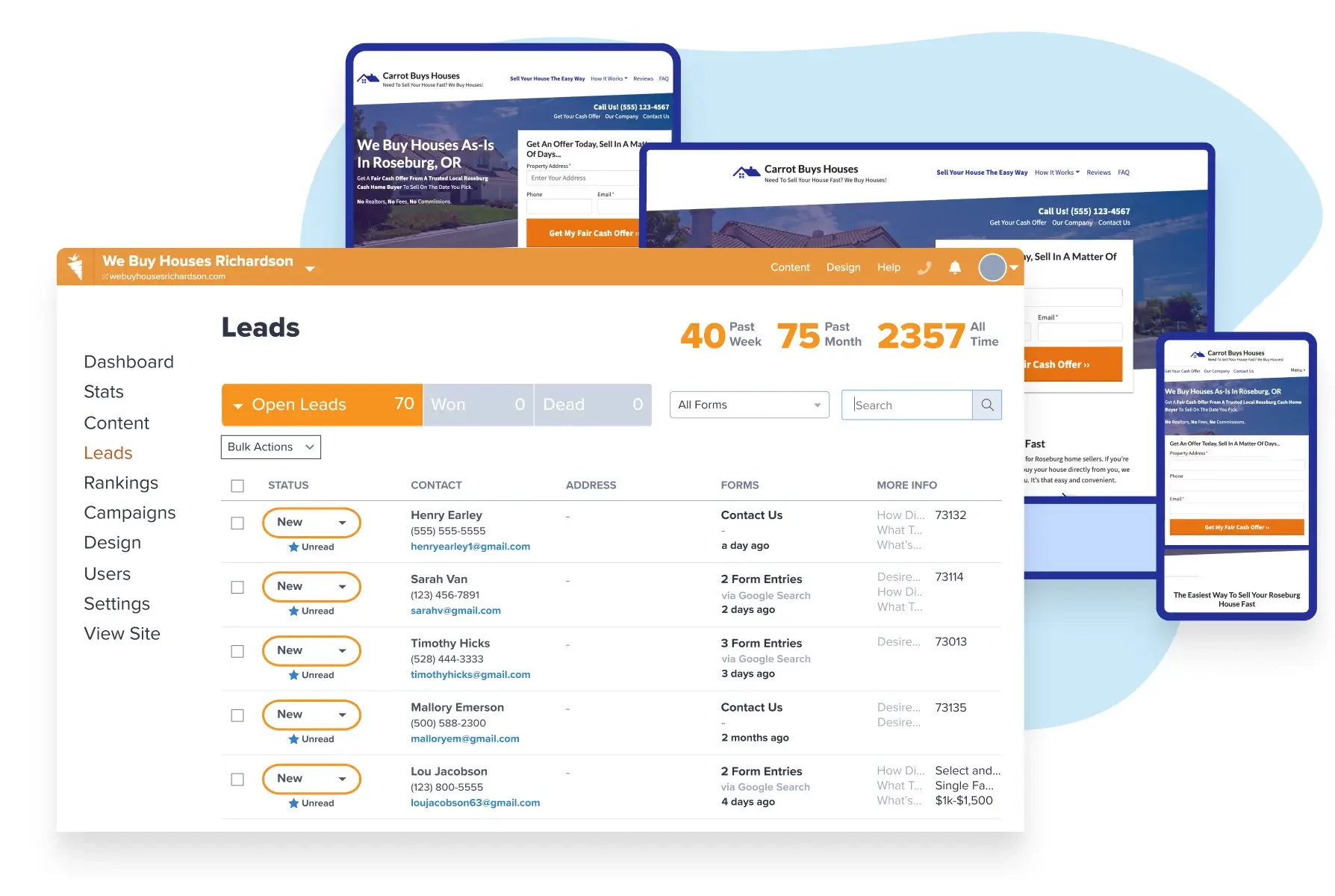

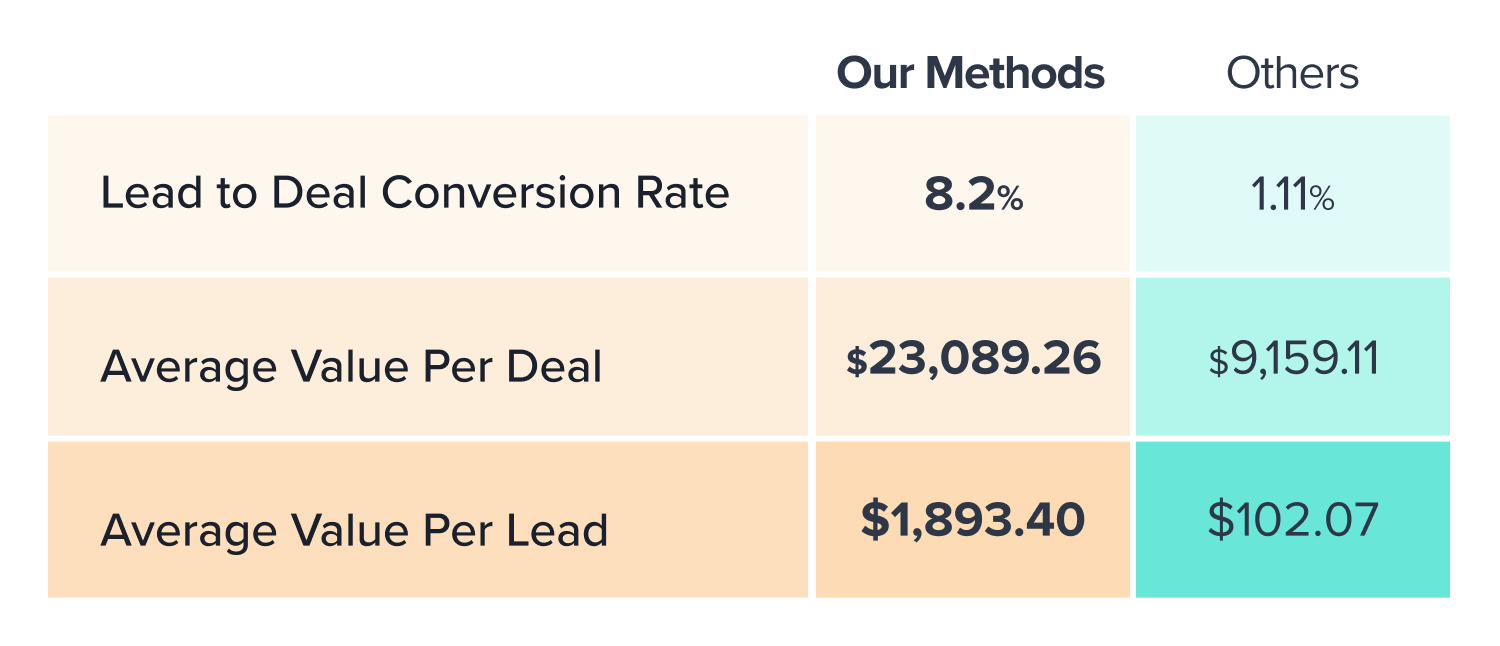

On average, 7x higher lead to deal conversion AND $13,930.15 in EXTRA profit per deal.

Leads generated through Carrot real estate investor websites experience a remarkable 7x higher conversion rate and yield 2.5x greater profitability than leads from non-Carrot sources (discover more about this here).

We wholeheartedly embrace our core values, and when it comes to our members’ success, we take “Adapt, Evolve, & Always Improve” and “Add Humanity To Business” very seriously.

Our commitment extends to staying ahead of factors that impact lead generation. This includes developing new lead generation templates, staying abreast of Google’s algorithm updates, and relentless testing. Our goal is to continually uncover fresh and inventive methods to enhance the performance of our members’ websites.

Carrot continues to be an excellent option for real estate investors in 2024 for several compelling reasons:

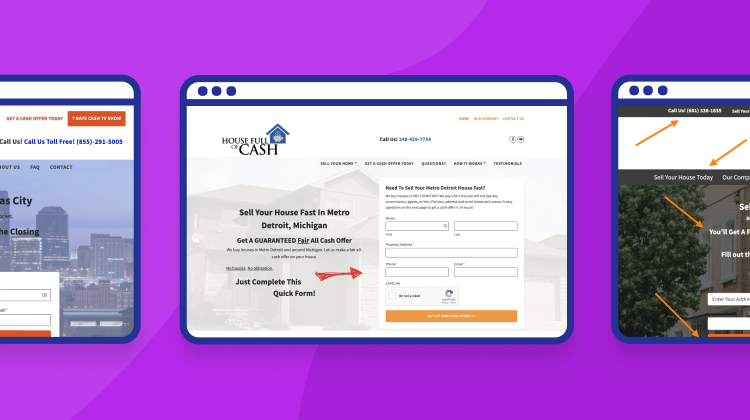

High-Quality Real Estate Investor Websites: Carrot provides investors with the tools to create professional and high-converting real estate websites. These websites are designed to attract motivated sellers, cash buyers, and other potential leads. The platform offers a range of customizable templates to suit various investment strategies.

SEO Optimization: Search engine optimization (SEO) is crucial for online visibility. Carrot websites are SEO-optimized, helping investors rank higher on search engine results pages (SERPs) and attract organic traffic. This can significantly reduce marketing costs and increase quality lead generation.

Content Marketing: Carrot offers content marketing features that enable investors to publish valuable, relevant, and engaging content on their websites. This content helps establish credibility, build trust with potential leads, and position investors as industry experts.

Lead Generation Tools: The platform provides lead generation tools and lead capture forms that prompt visitors to take action. Investors can capture contact information and other relevant details from potential sellers and buyers, allowing for personalized follow-up.

Conversion Optimization: Carrot is known for its focus on conversion rate optimization (CRO). The platform employs best practices and A/B testing to improve website conversion rates continually. This means more leads and potential deals for investors.

Mobile Responsiveness: With an increasing number of users accessing websites via mobile devices, Carrot ensures that its websites are mobile-responsive. This enhances the user experience and ensures investors don’t miss out on mobile traffic.

Educational Resources: Carrot provides investors with a wealth of educational resources, including blog posts, webinars, and guides. These resources help investors stay informed about industry trends, marketing strategies, and best practices.

Community and Support: Carrot has an active community of real estate investors who share insights, tips, and success stories. The platform offers customer support to assist users with technical or platform-related issues.

Integrated CRM: Carrot offers an in-house CRM for real estate, making it easy for investors to manage and follow up with their leads effectively. Carrot also integrates with other CRMs.

Performance Tracking: Carrot provides analytics and tracking tools that allow investors to monitor website performance, lead generation, and conversion metrics. This data-driven approach helps investors make informed decisions and refine their marketing strategies.

Customization Options: Carrot allows for extensive customization of websites, ensuring that they align with an investor’s unique brand and message. Investors can tailor their websites to specific niches and markets.

Competitive Pricing: Carrot offers pricing plans suitable for investors with various budgets, from beginners to seasoned professionals. Investors can choose plans that match their needs and scale as their business grows.

Carrot is a top choice for real estate investors due to its user-friendly website builder, SEO capabilities, content marketing tools, and commitment to conversion optimization.

The platform’s emphasis on education, community support, and mobile responsiveness makes it valuable for investors looking to establish a strong online presence and generate motivated seller leads in a competitive real estate market.

Visit carrot.com

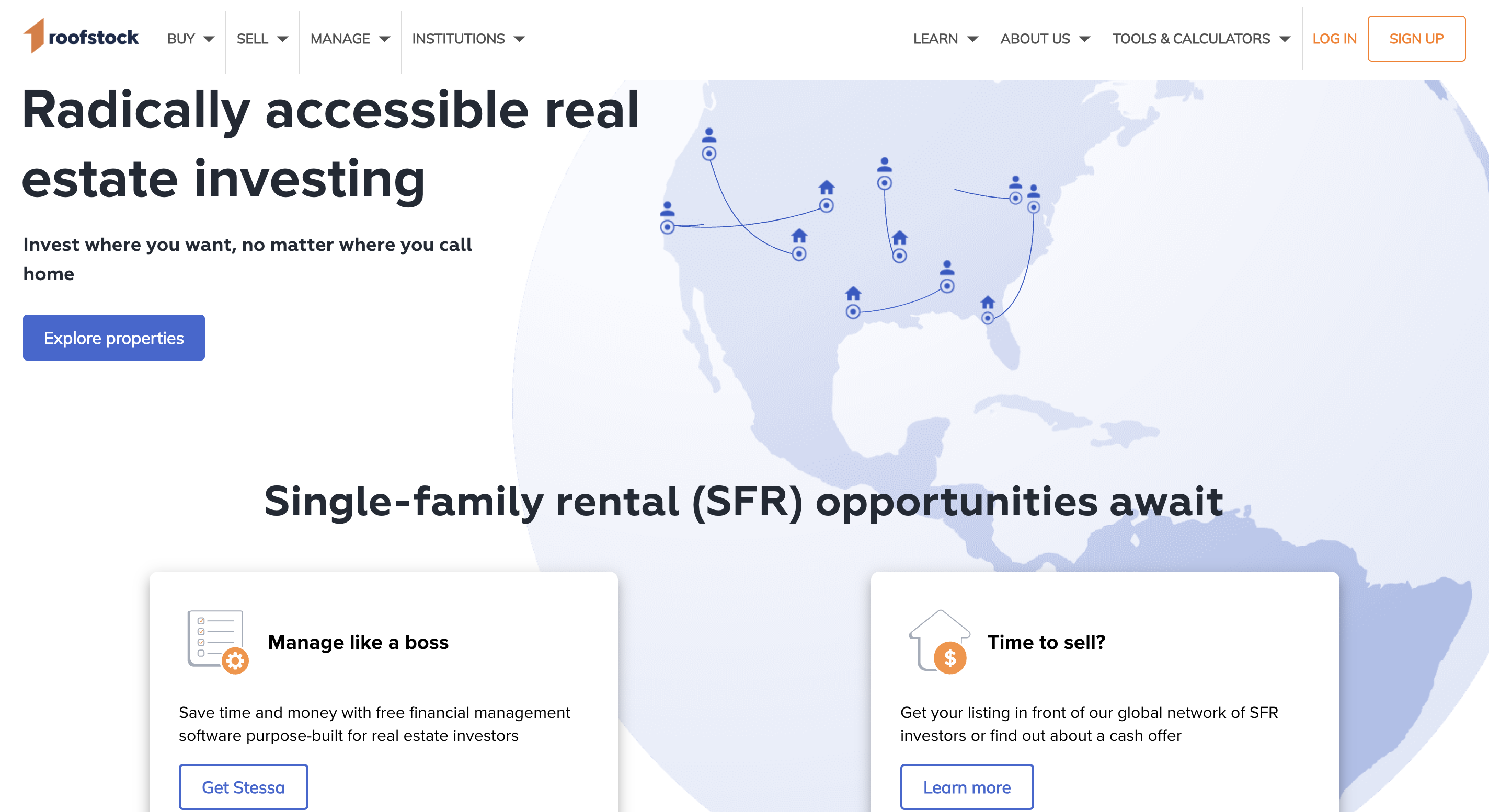

2. Roofstock

Roofstock is a compelling option for investors with real estate investor websites, especially those interested in single-family rental properties, due to its unique features and investor-focused approach. Here are some reasons why Roofstock is a good option:

Exclusive Marketplace for Single-Family Rental Properties: Roofstock offers single-family rental properties in various markets across the United States. Investors can browse various properties in different locations and find opportunities aligning with their investment goals.

Certified Pre-Owned Homes: Roofstock’s properties are “certified pre-owned,” meaning they have undergone a thorough inspection and evaluation process to ensure they are in good condition and rent-ready. Knowing they are investing in well-maintained properties gives investors peace of mind.

Tenant-Occupied Properties: One of the significant advantages of Roofstock is that many of its properties are already tenant-occupied. This allows investors to start earning rental income from residential properties from day one without the need to find and screen tenants themselves.

Transparent Property Information: Roofstock provides detailed property information, including financial projections, rental history, property reports, and inspection details. Investors can access all the essential data they need to make informed investment decisions.

Property Management Services: For investors who prefer a hands-off approach, Roofstock offers property management services through its network of vetted property managers. This service helps investors efficiently manage their rental properties and optimize rental income.

In-Depth Neighborhood Data: Roofstock provides extensive neighborhood data, including crime rates, school ratings, and other essential statistics. This information helps investors assess the desirability and potential for rental demand in specific locations.

Visit roofstock.com

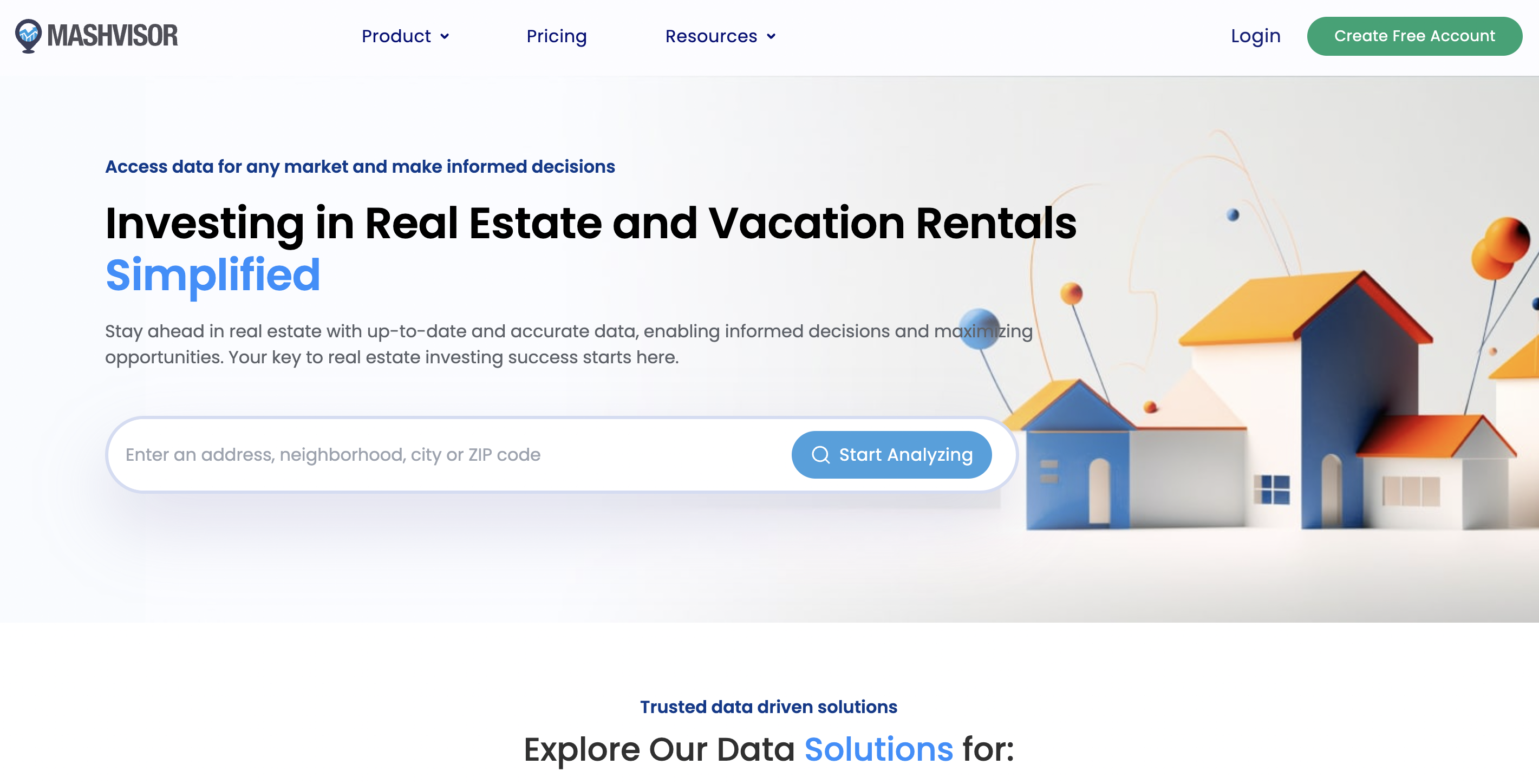

3. Mashvisor

Mashvisor is a fantastic option for real estate investors for several reasons:

Comprehensive Property Analytics: Mashvisor provides in-depth property analytics and data for traditional and Airbnb investment properties. Investors can access key metrics such as rental income, occupancy rates, cash flow, cap rate, and more, helping them make informed decisions about potential investments.

AI-Powered Investment Tools: The platform utilizes artificial intelligence to offer predictive analytics and investment insights. Mashvisor’s algorithms analyze vast amounts of real estate data to identify lucrative investment opportunities and forecast property performance.

Property Search and Analysis: Investors can easily search for properties that match their investment criteria using Mashvisor’s intuitive interface. The platform streamlines property analysis, saving investors time and effort in finding the best investment deals.

Neighborhood Analysis: Mashvisor provides comprehensive neighborhood analysis, including data on property prices, rental demand, and investment potential. This information helps investors identify high-growth areas and pinpoint locations that align with their investment goals.

Heatmap Feature: The platform’s feature allows investors to visualize the potential rental income and Airbnb occupancy rates across different neighborhoods. This visual representation aids in comparing and selecting the most lucrative locations for investment.

Investment Property Financing: Mashvisor offers tools to estimate mortgage payments and financing options for investment properties. This feature helps investors assess the financial feasibility of their investments accurately.

Property Management Insights: Investors can access data on property management fees, enabling them to factor in these costs while calculating potential returns. This information is particularly useful for investors considering hiring property management services.

Historical and Forecasted Data: Mashvisor provides historical and forecasted data on property performance, giving investors a long-term perspective on their investments’ potential appreciation and cash flow.

Property Comparisons: The platform allows investors to compare multiple investment properties side by side, facilitating quick and effective decision-making based on data-driven insights.

Investment Strategies: The platform caters to different investment strategies, including traditional rentals, Airbnb rentals, and short-term rentals. Investors can tailor their searches and analyses based on their preferred investment approach.

Visit mashvisor.com

4. Stessa

Stessa is an excellent option for real estate investors due to its comprehensive tools and features designed specifically for property management and real estate portfolio tracking. Here are some reasons why Stessa is a valuable platform for investors:

Portfolio Management Made Easy: Stessa simplifies the management of real estate portfolios by providing a centralized platform to track and monitor all properties in one place. Investors can easily view the performance of their entire portfolio at a glance, making it convenient to assess overall financial health.

Automated Income and Expense Tracking: Stessa automates the process of tracking income and expenses for each property. The platform integrates with bank accounts and property management software, automatically categorizing transactions and generating detailed financial reports. This feature saves investors significant time and effort on manual bookkeeping.

Property Performance Analytics: Stessa offers each property’s in-depth analytics and performance insights. Investors can access metrics such as cash flow, net operating income (NOI), cap rate, and return on investment (ROI), enabling them to make data-driven decisions to optimize their portfolio’s profitability.

Document Management: Stessa provides secure cloud storage for all property-related documents, including leases, vendor contracts, and property photos. This organized document management system ensures essential paperwork is readily accessible when needed.

Tax Reporting Made Simple: With Stessa’s accurate income and expense tracking, tax reporting becomes seamless for real estate investors. The platform generates detailed tax-ready reports, simplifying tax preparation and potentially reducing accounting costs.

Property Insights and Alerts: Stessa’s platform includes AI-powered insights and alerts that notify investors about potential issues or opportunities within their portfolios. These proactive alerts help investors stay on top of maintenance needs, rent collection, lease expirations, and more.

Integration with Other Tools: Stessa seamlessly integrates with various popular property management and accounting software, allowing users to connect their existing tools and consolidate data for a more holistic portfolio view.

Visit stessa.com

5. BatchLeads

BatchLeads remains a strong option for real estate investors in 2024 due to its robust lead generation capabilities, customization options, and integrated marketing and lead management tools. Its focus on data accuracy and off-market opportunities makes it a valuable asset for investors seeking to identify and capitalize on motivated seller leads in a competitive real estate market.

High-Quality Leads: BatchLeads provides access to a vast database of high-quality real estate leads. Investors can target motivated sellers, distressed properties, vacant homes, and more. The platform’s extensive data coverage ensures investors have a wide range of lead options.

Customized List Building: Investors can create customized marketing lists tailored to their investment criteria. This customization allows for precise targeting, enabling investors to focus on properties that align with their strategies.

Off-Market Opportunities: BatchLeads offers access to off-market leads, properties not actively listed on the MLS. This gives investors a competitive advantage, as they can identify opportunities before they become widely available to other buyers.

Skip Tracing: The platform includes skip tracing services, helping investors locate and contact property owners efficiently. Skip tracing can be valuable for contacting motivated sellers and negotiating deals.

Integrated CRM: BatchLeads has a built-in Customer Relationship Management (CRM) system. Investors can manage their leads, track interactions, and streamline communication, improving efficiency in lead management.

Direct Mail and Marketing Tools: The platform offers integrated direct mail and marketing features, allowing investors to create and send targeted marketing campaigns. This feature simplifies reaching out to potential sellers and engaging with leads.

Property Details and Analytics: BatchLeads provides comprehensive property details, ownership history, transaction history, and more. Investors can access valuable property insights to make informed investment decisions.

Data Accuracy: Data accuracy is crucial in real estate investing. BatchLeads strongly emphasizes data quality, helping investors avoid wasting time and resources on inaccurate or outdated information.

Integration Capabilities: The platform may offer integrations with other real estate software and tools, enhancing its functionality and compatibility with an investor’s existing toolkit.

Visit batchleads.io

6. DealMachine

DealMachine is a valuable tool and platform that can greatly benefit real estate investors for several reasons:

Driving for Dollars Technology: DealMachine’s unique “Driving for Dollars” technology enables investors to find distressed or off-market properties by driving around neighborhoods. The app uses the phone’s GPS to identify properties and provides immediate access to property owner information for follow-up.

Direct Mail Marketing: DealMachine specializes in direct mail marketing for real estate investors. The platform allows investors to easily create and send personalized postcards to property owners in targeted areas. This direct mail approach can effectively generate leads and identify potential investment opportunities.

Lead Generation and Acquisition: With DealMachine, investors can use the platform’s built-in property research tools to find properties with investment potential. The app’s features, such as property information, owner contact details, and property history, help investors assess the viability of each lead and make informed decisions.

CRM Integration: DealMachine seamlessly integrates with popular customer relationship management (CRM) systems, allowing investors to manage leads, track progress, and streamline their workflow efficiently.

In-App Communication: The platform offers a built-in messaging system that enables investors to connect directly with property owners through text messaging or direct mail. This direct communication feature can help establish a rapport with potential sellers and increase the chances of successful negotiations.

Lead Scoring and Tracking: DealMachine provides lead-scoring tools to prioritize potential deals based on specified criteria. This feature helps investors focus on the most promising opportunities and manage their time effectively.

Property Analysis: DealMachine offers property analysis tools to help investors evaluate potential deals. By accessing property details and historical data, investors can make informed decisions and assess a property’s potential return on investment.

Mobile Accessibility: As a mobile app, DealMachine provides the flexibility and convenience for investors to manage their real estate activities on the go. Whether driving for dollars, analyzing properties, or communicating with owners, investors can access the platform from their smartphones or tablets.

Visit dealmachine.com

7. BiggerPockets

BiggerPockets is a highly regarded and valuable resource for real estate investors for the following reasons:

Knowledge Hub: BiggerPockets is a vast knowledge hub for real estate investors at all levels of experience. The platform offers a wide range of educational content, including articles, blog posts, podcasts, videos, and forums, covering various aspects of the real estate investing journey.

Community and Networking: BiggerPockets boasts one of the largest and most active real estate investing communities. Investors can connect with like-minded individuals, network with experienced professionals, and participate in discussions to gain insights and valuable advice.

Forums and Q&A: The platform’s forums and Q&A sections allow investors to ask questions and seek guidance on specific real estate investment topics. Users can receive input from experienced investors, mentors, and industry experts.

Real Estate Calculators: BiggerPockets offers a suite of real estate investment calculators, enabling investors to perform in-depth financial analysis on potential properties. These calculators help users evaluate market data, cash flow, return on investment, and other crucial metrics.

Marketplace: The BiggerPockets Marketplace provides a platform for buying, selling, and finding investment properties. Investors can access a wide range of real estate deals, including off-market properties and opportunities from other community members.

Supportive Community Culture: The platform fosters a positive and supportive community culture, encouraging investors to share their successes, failures, and lessons learned, creating a space for continuous learning and growth.

Visit biggerpockets.com

8. SparkRental

SparkRental is a good option for real estate investors for several reasons:

Tenant Screening Services: SparkRental provides comprehensive tenant screening services, allowing investors to make informed decisions when selecting tenants for their rental properties. This feature helps minimize the risk of rental income loss and potential property damage.

Rent Collection and Payment Services: The platform offers rent collection and payment services, streamlining the rental management process for landlords. This feature ensures timely and hassle-free rent payments for both landlords and tenants.

Rental Property Analysis Tools: SparkRental provides advanced rental property analysis tools that help investors assess the potential profitability of prospective investments. These tools include cash flow calculators, cap rate calculators, and investment property analysis reports.

Landlord Forms and Documents: The website offers a collection of landlord forms and documents, such as lease agreements and rental applications, saving investors valuable time and effort in creating these documents from scratch.

Focus on Passive Income: The platform emphasizes passive income strategies, guiding investors on how to build a portfolio that generates reliable and consistent rental income over time.

Personal Finance Tools: Besides real estate-specific tools, SparkRental offers personal finance resources and budgeting tools, allowing investors to manage their finances more effectively and make informed investment decisions.

Visit sparkrental.com

9. PropStream

PropStream empowers investors to rapidly create precise leads and marketing lists by leveraging over 120 property search filters and statuses. Whether you prefer customizing your filters or opting for pre-defined quick lists, our platform is your gateway to identifying motivated sellers, whether their properties are currently on the market or off-market.

PropStream remains a great choice for real estate investors in 2024 due to several key reasons:

Motivated Seller Leads: PropStream provides access to both on-market and off-market property listings. This is particularly valuable for investors seeking motivated sellers who might not actively advertise their properties. Access to off-market listings can give investors a competitive edge in finding lucrative deals.

Comprehensive Property Details: PropStream provides comprehensive property details, including ownership history, transaction history, tax information, and more. This wealth of information equips investors with the knowledge to negotiate favorable deals.

Integration Capabilities: It offers integration options with various real estate tools and software, enhancing its versatility and compatibility with an investor’s existing toolkit.

Extensive Data: PropStream offers access to an extensive database of real estate information. With over 120 property search filters, investors can narrow their leads to target specific properties matching their investment criteria. This wealth of data enables investors to make well-informed decisions.

Customization: The platform allows users to set their filters and criteria, tailoring their searches to their unique investment strategies. Whether you’re looking for distressed properties, foreclosures, or specific property types, PropStream can be customized to meet your needs.

Market Insights: PropStream offers valuable market insights and analytics. Investors can analyze property trends, neighborhood data, and market statistics to identify emerging opportunities and make informed decisions.

Time and Cost Efficiency: By streamlining the lead generation process, PropStream helps investors save time and resources. It eliminates manual research and allows investors to focus on deal analysis and negotiation.

Visit propstream.com

10. RealtyMogul

RealtyMogul is an excellent real estate investor website option due to its innovative approach to crowdfunding and investment opportunities. Here are several reasons why RealtyMogul.com is a standout choice for investors:

Diverse Investment Opportunities: RealtyMogul offers many investment opportunities, including commercial properties, residential assets, and specialized real estate projects. Investors can choose from various deals, allowing them to tailor their portfolio to their specific investment preferences.

Access to Institutional-Quality Deals: The platform curates investment opportunities from reputable real estate sponsors and partners. These projects undergo rigorous due diligence, providing investors with high-quality deals typically with institutional-grade investments.

Passive Real Estate Investing: RealtyMogul enables investors to participate in real estate deals passively. Investors can co-invest with experienced real estate professionals, leaving the day-to-day management and operational responsibilities to the experts.

Investor Protection: RealtyMogul places a strong emphasis on investor protection. The platform conducts thorough underwriting and risk assessment for each deal, aiming to align investor interests with the success of the projects.

Low Minimum Investments: RealtyMogul offers relatively low minimum investment amounts, making it accessible to a broader range of investors. This feature allows individuals to diversify their investments across multiple projects, even with a modest initial capital.

Streamlined Investment Process: RealtyMogul simplifies the investment process, making it convenient for investors to participate in projects that align with their investment goals. The platform handles administrative tasks, allowing investors to focus on building their portfolios.

Real Estate Investment Trusts (REITs): In addition to individual property investments, RealtyMogul offers access to Real Estate Investment Trusts (REITs). REITs allow investors to pool their funds with others to invest in a diverse portfolio of real estate assets, providing further diversification and liquidity.

Visit realtymogul.com

Closing Thoughts

Exploring the extensive landscape of real estate investor websites can be overwhelming. Some websites focus on educating investors about the real estate industry and fostering peer connections.

With these cutting-edge technology-driven platforms, you take charge of your investment choices, determining where your funds are allocated and the depth of your financial involvement. Some platforms prioritize lead generation, while others excel in market analysis, property selection, and simplifying the investment journey.

We’re interested in hearing about the tools you rely on, too. Feel free to share your thoughts in the comments below; we’re eager to learn about your preferences and experiences.